This site was created specifically for people from Canada, for quick acquaintance with the gambling industry online. In today's article, you can know all about Bitcoin Basics to Know in Canada. Our Canadian visitors have asked us so many times to write the review of "A Guide on How to Start Trading Bitcoin Cryptocurrency for Canadians, Bitcoin Basics to Know in Canada" because of high interest in this topic. Well, the thorough investigation by our gambling expert had been already finished and we have collected here all useful information about Bitcoin Basics to Know in Canada in one review. You may read it now!

Bitcoin Basics to Know in Canada

As a die-hard index investor, it was difficult to even add $100 worth of play money to something as speculative as Bitcoin. But even I’ll admit it’s hard not to get caught up in the hype surrounding cryptocurrency and Bitcoin in particular. Crypto bought through Wealthsimple is held in trust and stored in a cold wallet at Gemini, a regulated cryptocurrency custodian. Bitcoin (and Ethereum) must be bought and sold within Wealthsimple Crytpo.

A Guide on How to Start Trading Bitcoin Cryptocurrency for Canadians

Modified date: February 17, 2021

The hype around Bitcoin trading has certainly died down since its meteoric price rise in 2017. But the story of Bitcoin is still being written, and a new trading platform just might be the key to gaining more attention (and trust) from Canadian investors.

Bitcoin is a digital currency or online version of money that is stored in a digital wallet (on a computer or mobile app). This “cryptocurrency” is the first peer-to-peer payment network powered by its users rather than a central authority or middle-person (like a bank). A public ledger, or blockchain, records every single transaction between users.

More than just a medium of exchange, however, Bitcoin is also hyped as an investment. It’s by far the largest and most popular cryptocurrency in the world and, amazingly, investors have already been trading Bitcoin for more than 10 years. At the height of its popularity in 2017, one Bitcoin was worth $19,783 (USD). Today, the price of a Bitcoin hovers around $12,000 (USD).

Bitcoins are “mined” by using computer power to solve a complex cryptographic problem. Successful miners receive a “block reward” or a predetermined number of Bitcoin. There is a finite supply of 21,000,000 Bitcoins that can be mined – and today there are more than 18 million Bitcoins in circulation. That gives Bitcoin a market cap of more than $221 billion (USD), or roughly the same size as companies like Netflix, Bank of America, and Disney. It is estimated that the final Bitcoin will be mined in 2140.

Bitcoin Storage

You can store your Bitcoin on an exchange, or digital marketplace, where you can buy or sell Bitcoins using government currencies (CAD, USD, etc.) or other alt-coins. Popular cryptocurrency exchanges include CoinBase Pro, Gemini, and Binance.

Since cryptocurrency and exchanges are largely unregulated, they are prime targets for hackers. In 2019, 12 exchanges were hacked, including Binance – which lost 7,000 Bitcoins worth $40 million.

Instead of using an exchange, you can store your Bitcoin(s) in a wallet. A “hot” wallet essentially stores your Bitcoin online, making it easier to transact but also more susceptible to being hacked.

A cold wallet stores your Bitcoin offline. In basic terms, it’s a computer with an operating system and Bitcoin wallet, but that is not connected to the internet. This is obviously a more secure, but less convenient solution.

How to Start Bitcoin Trading in Canada

Bitcoin is heavily traded as an investment, with an average of $25 billion worth of Bitcoin traded each day. During the height of the Coronavirus crisis in March, nearly $75 billion worth of Bitcoin was traded in a single day.

As discussed, you can trade Bitcoin with other users on an exchange. There are no fees to sign up and hold Bitcoin on exchanges like CoinBase Pro. Instead, exchanges make money on trading fees – up to 0.50% on each order (known as a spread fee), plus an additional fee that can equal up to 1.49% of the trade.

Investors can buy one whole Bitcoin, but with the price above $10,000, it’s more common for crypto traders to buy fractions of one Bitcoin.

Wealthsimple Crypto

Recently, Wealthsimple launched its own Wealthsimple Crypto trading platform through the Wealthsimple Trade mobile app. Clients can now trade Bitcoin and Ethereum with as little as $1. Plus, you can take advantage of our exclusive promo offer: open a new Wealthsimple Crypto account, and get a $50 cash bonus + $0 commission trades. All you have to do is deposit and trade at least $250. Sign-up today to take advantage of this exclusive offer.

I opened a Wealthsimple Crypto account, funded it with $100, and bought Bitcoin to see what the process was like. Here’s how to trade Bitcoin in Canada:

- Open a Wealthsimple Crypto account: You must initially join a waitlist, but Wealthsimple Crypto has been slowly released to users starting in August 2020. Wealthsimple Crypto is available on iOS and Android through the Wealthsimple Trade app.

- Fund your Wealthsimple Crypto account: Add money to your account through a linked bank account to make your first trade. Note that once you make a deposit your funds won’t be ready to trade for five business days.

- Buy Bitcoin in your Wealthsimple Crypto account: Once your deposit has cleared you can start trading Bitcoin. Select “Bitcoin,” tap the “buy” button, and enter the dollar amount you want to buy.

My $100 purchase bought a whopping 0.006210 worth of Bitcoin.

Crypto bought through Wealthsimple is held in trust and stored in a cold wallet at Gemini, a regulated cryptocurrency custodian. Bitcoin (and Ethereum) must be bought and sold within Wealthsimple Crytpo.

Why You Should Trade Bitcoin

As a die-hard index investor, it was difficult to even add $100 worth of play money to something as speculative as Bitcoin. But even I’ll admit it’s hard not to get caught up in the hype surrounding cryptocurrency and Bitcoin in particular.

Whether you call it a store of value (like gold), a medium of exchange (like fiat currency), or a purely speculative investment, there’s no denying that Bitcoin has captured the attention of investors and we’re just at the beginning of its story.

At its peak popularity in 2017, the price of one Bitcoin increased from $909 to nearly $20,000. The highly speculative investment then proceeded to fall to around $3,100 just one year later. Still, if you held onto your investment from January 2017 to December 2018 you would have still seen price appreciation of 240%.

We’re still in the early stages of Bitcoin and other cryptocurrencies. Investing in Bitcoin may provide investors with a coveted “uncorrelated” asset to diversify their stock and bond portfolios.

There’s a scarcity factor since there are only so many Bitcoins that can be mined. That alone can increase the price over time. Finally, there’s the idea of widespread adoption of cryptocurrency as an alternative to fiat or government currency. If that idea ever takes off, Bitcoin is certainly at the forefront as the most popular cryptocurrency.

Is Bitcoin Trading Worth It?

Is Bitcoin trading right for you? It may be if used an alternative asset class like gold, which is a store of value that can be highly speculative and often performs well during volatile markets.

Bitcoin can be traded frequently by day traders and the like, who enjoy trading investments that can gyrate up and down unexpectedly. But, if you’re the type of investor who is passionate about Bitcoin, and cryptocurrency in general, then consider dedicating 5-10% of your portfolio to Bitcoin and hold on for dear life.

Article comments

Good post. And now bitcoin is set to take out $20,000 US or $26,000 or so Canadian. So many institutions have piled on/in, in the last few weeks and months.

That it will have widespread and mainstream acceptance now is a done deal.

The only question might be supply and demand – and hence the price.

But hang on, this is so volatile, of course.

This is a no-brainer as an investment asset IMHO. At 2-3% of portfolio weighting as many suggest. The family shops serving the well to do appear to assign a greater weighting.

This is more than interesting to watch, and to hold. Bitcoin amount will be rebalanced/trimmed with regularity once it gets to an outrageous level рџ™‚

How to Buy Bitcoin in Canada?

What is Bitcoin?

Bitcoin is a currency, more commonly referred to as a cryptocurrency that is created and exists in electronic form, with no physical version for Bitcoin holders to possess.

Bitcoin was created by Satoshi Nakamoto and was released in 2009. Nakamoto’s vision was to create a digital currency that falls out of the reach of governments and central banks.

Bitcoin continues to grab the headlines, but it’s not just the currency itself that is worthy of praise, with the blockchain technology behind the currency considered to be a first of its kind.

The ethos of Bitcoin and other cryptocurrencies is the decentralized element. Bitcoin transactions all over the world are recorded and stored on the blockchain. The blockchain is a public ledger that is found on all of the computers within the Bitcoin network. All of the ledgers are synchronized with no master ledger.

The verification and update process for Bitcoin transactions is referred to as Bitcoin mining. The process is independent, with miners selected at random to verify transactions over a given period of time. Once the verification is complete, the transaction information is incorporated into a block, which then links to the blockchain. Miners receive Bitcoins as a reward for the verification process.

With the decentralized ethos of Bitcoin, the other attribute is the anonymity given to those buying, selling or holding Bitcoins.

Since the evolution of Bitcoin, other cryptocurrencies have hit the market as having offshoots of Bitcoin itself, with Bitcoin Cash and Bitcoin Gold having been created in the 2 nd half of this year.

How to Buy Bitcoin in Canada?

Buying Bitcoin in Canada could be done in various ways: Via Bitcoin exchanges, through CFD’s or through ATM’s. While buying Bitcoin via exchange and ATM’s provides you the legal possession of the cryptocurrency in a digital wallet, purchasing Bitcoin via CFD’s brokers allows you to trade bitcoin’s price fluctuations without holding the coin. Currently, many who would like to invest in Bitcoin are in search of Bitcoin exchanges offering Bitcoin to Canadian investors.

One of the top leading and reliable Bitcoin exchanges is CEX.IO, the exchange has a low trading fee of just 0.2% and allows customers to buy Bitcoins with credit cards, bank transfers, SEPA transfers, cash or AstroPay. Credit card purchases are immediate. Below is a complete guide to buying Bitcoin via CEX.IO in 4 easy steps.

Step 1 – Open a Digital Wallet

A digital wallet is where you hold your cryptocurrencies and interacts others via the blockchain technology. There are many providers of digital wallets, however, it is important to make a deep research before you decide which one is the best for you. Currently, the most popular digital wallets provider is Blockchain.info.

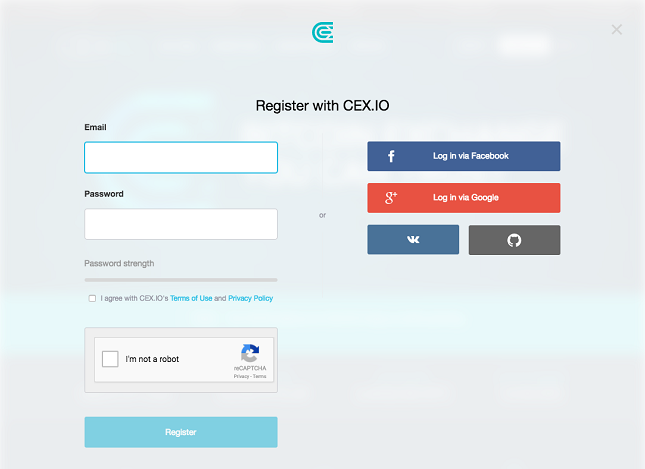

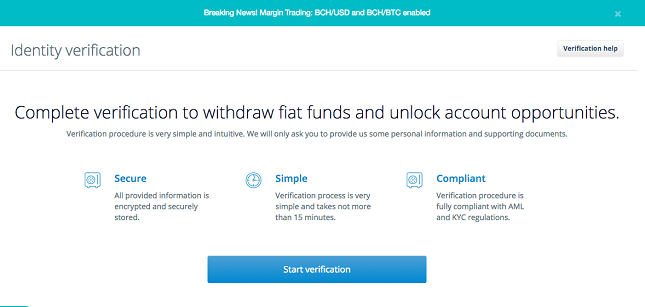

Step 2 – Register & Open an Account

Once you enter CEX.IO website, register and open an account that can provide you with their service.

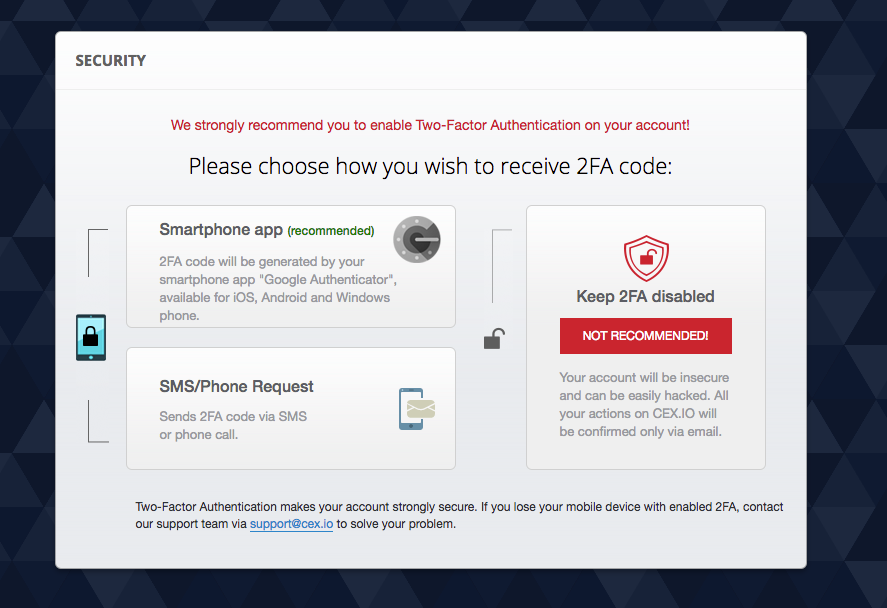

Step 3 – Receive the 2FA Code

This is the authentication code as well as your password when you access CEX.IO. The code will be generated by an application and will be delivered to you by SMS.

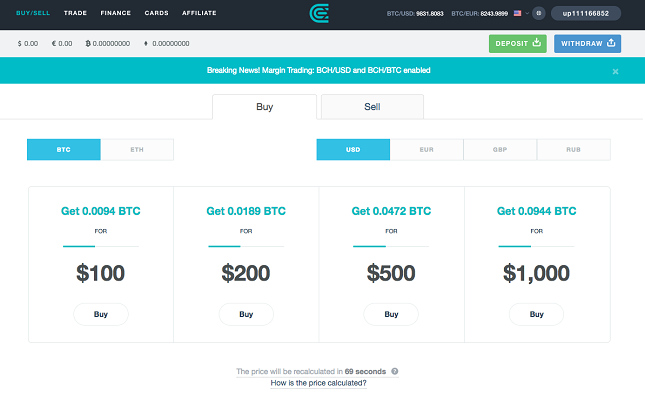

Step 4 – Purchase Bitcoin

Now you can easily purchase Bitcoin and other cryptocurrencies. Note that you can always buy fractions of Bitcoin and CEX.IO allows you to choose fixed amounts with your own currency.

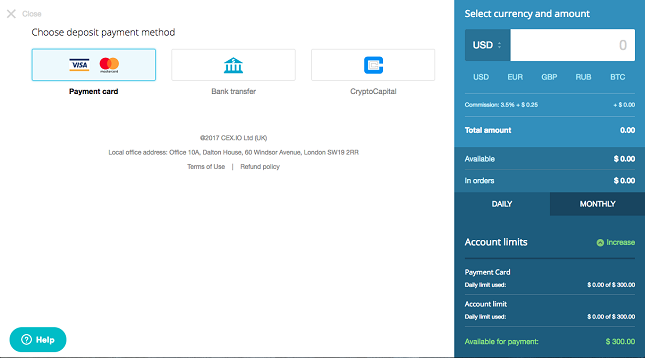

Choose the payment option that is most convenient for you.

In order to complete the purchase, the broker will ask you to verify your identity with documents and various details.

Apart from CEX.IO, there are other Bitcoin exchanges that provide their services in Canada:

Coinbase – Supports 32 countries with more than 10m customers served. Canadian customers can buy using credit and debit cards, with fees of 3.99% for purchases. When buying Bitcoins with bank transfers, it can take up to 5-days however.

Coinmama: For purchases of under $150, there is no requirement to verify identity, though there is a transaction fee of around 6% for customers buying Bitcoins with credit or debit cards, which is very high.

GDAX: Considered to be one of the larger U.S Bitcoin exchanges and customers can transfer funds via bank transfer, SEPA or bank wire. The exchange is also considered competitive from a fee perspective.

Canadian Bitcoins: Customers are able to select from a wide range of funding options including Interac Online, online banking, direct debit from bank account, cash via mail, cash in person,

Satoshi Counter: Customers are able to buy face-to-face in Montreal and online in the rest of the country. The exchange also permits Bitcoin transactions up to $1m, though the company requires additional identity verification for larger transactions.

QuickBT: A Canadian broker that sells small amounts of Bitcoin ($200 cap) via Interac Online, Flexepin vouchers or debit card, with the Bitcoins released within minutes of payment.

How to Trade Bitcoin in Canada?

If the sound of a Bitcoin exchange is off-putting, the alternative is to buy and sell Bitcoins via CFD’s brokers. Trading Bitcoin through CFD’s provides the ability to buy and sell the price of Bitcoin without actually holding the currency.

As the market has evolved, trading platforms have also evolved, with traders being offered leverage and the ability to go long and short on Bitcoin by investing in CFDs.

One of the most well-known brokers, providing cryptocurrencies trading, is AvaTrade. Below is a complete guide to buying Bitcoin via AvaTrdae in 3 steps:

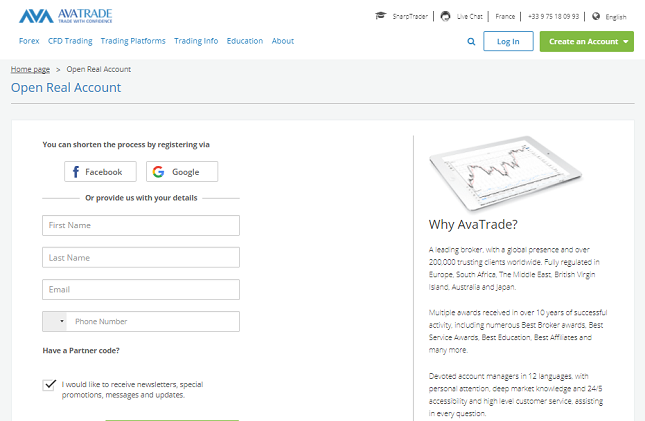

Step 1 – Open an Account

Firstly, you need to open an account via AvaTrade. The process is simple and easy and all required is to provide identifying documentation.

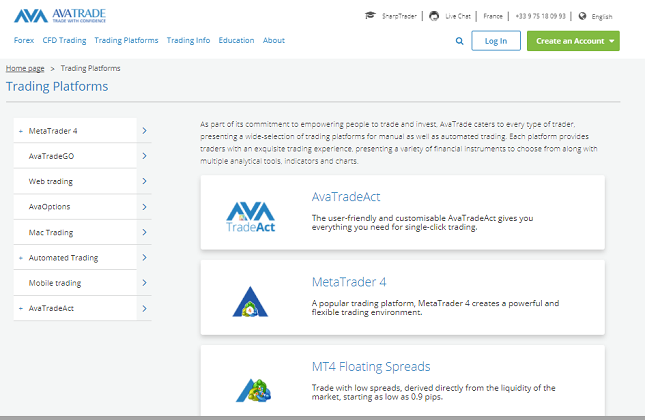

Step 2 – Download AvaTrade Trading Platform

Following your account registration, download AvaTrade’s trading platform (we recommend Meta Trader 4) and explore the platform. MT4 is a user-friendly platform that enables all the basic and advanced trading tools.

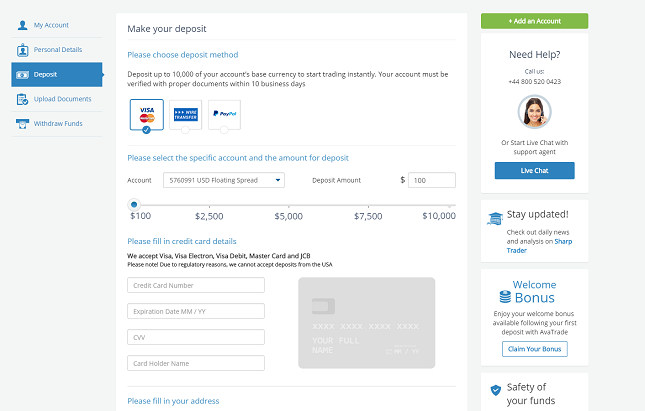

Step 3 – Fund Your Account

The final step towards trading Bitcoin through AvaTrade is to fund your account. Note that AvaTrade accepts credit card, wire transfer, and Paypal as payments methods.

Where can I Use Bitcoin in Canada?

There are a number of retail and service providers in Canada who accept Bitcoins for payment of goods and services. Dell, Expedia, and TigerDirect.ca are a few. Perhaps of greater interest is Coincards.ca. The company sells prepaid gift cards that can then be used at Air Canada, Amazon, Apple, Cineplex, Costco, Canadian Tire, Toys “R” Us, and many more.

Bitcoin holders are even able to pay their bills using Bitcoin. Bylls provides a platform to pay select from a list of over 6,500 biller companies, send funds directly to your bank account or send funds into a personal payee account for friends and family.

While the number of retailers accepting Bitcoin directly may be on the smaller side, the combined reach of Coincards and Bylls alone is significant and propels Canada into the forefront, when it comes to transitioning away from the use of fiat currency.

For Bitcoin holders looking to keep up to date with which retailers accept Bitcoin, Coinmap is the place to go.

Bitcoin ATMs in Canada

Bitcoin ATMs are not to be confused with the more traditional bank ATMs that are linked to banking networks to allow bank customers to withdraw and deposit fiat money and make other banking requests.

Bitcoin ATMs are linked to the internet and have no connection to the bank networks. The purpose of the ATMs is to provide a platform for the buying and selling of Bitcoin. With a particularly limited verification process, ATMs provide buyers and sellers with a high degree of anonymity, which is one of the desired characteristics of Bitcoin. For this, however, the transaction fees are on the higher side with the limits on the size of transactions being lower than on Bitcoin exchanges.

The world’s first Bitcoin ATM was reportedly opened in a coffee shop in Vancouver back in 2013. The ATM used palm and ID scan technology to allow Bitcoin transactions. Bitcoin was c$200 at the time that the ATM was installed…

There are a total of 304 Bitcoin ATMs in Canada, with the largest concentration of ATMs being in Calgary (30), Montreal (47), Toronto (118) and Vancouver (47).

In Canada, the buying fees of between 7-8% are more in line with the global average of around 8%, while the fees for the sale of Bitcoins are more competitive and in the range of between 4-6%, more aligned with the global average.

Looking at ATM fee averages on a global basis, Bitcoin purchase fees are 8.45% on average, with redemption fees averaging at 7.03%.

To find the nearest Bitcoin ATM, Coin ATM Radar is a good website to search for the nearest Bitcoin ATM. For many, the distances will certainly too great to travel in order to buy or sell Bitcoin, which would leave buying and selling via an exchange or on sites such as LocalBitcoin.

Conclusion

Canada has certainly embraced Bitcoin and is reflected in, not only the easy purchase of Bitcoin from Bitcoin exchanges but with the ability to purchase goods and services across the goods and services sector.

Fees seem to be on the more competitive side, particularly when looking for anonymity and based on the above findings, Canada could be considered as one of the more advanced markets in moving away from the use of Fiat Currency for day to day living.

The downside for those looking to use Bitcoin in the more remote areas of the country is that most of the ATMs and retailers accepting Bitcoin are located in the most populated areas. So, while the major cities may be able to limit the use of the Canadian Dollar, other areas are unlikely to be out with the palm pilot or laptop just yet.

How to Pay with Bitcoin in Canada

Bitcoins is a cryptocurrency that can be used for online payments all over the world and in Canada as well. Some land-based companies also allow using this payment method. Find out comprehensive information on that by reading this detailed review.

What Is Bitcoin Payment?

This is a payment solution that can be used to purchase goods and make payments with bitcoins. Merchants can implement this payment option on their website to allow their customers to make purchases based on the current bitcoin rate.

Is it legal and safe to pay with Bitcoin in Canada?

It is absolutely legal to purchase and sell cryptocurrencies in Canada. You can use this cryptocurrency to purchase various products on merchants' websites as well as make deposits and withdrawals from your account with third-party services, such as online casinos.

How to Use Cryptocurrency

There are a variety of ways to use this cryptocurrency. This makes it a versatile tool for online payments and money transfers.

Purchase of Products

There is a range of merchants that allow customers to pay for their purchases using bitcoins. This payment option is getting more and more popular, so the number of such websites is expected to grow.

Currency Exchange

You can exchange bitcoin for other cryptocurrencies or fiat currencies. In this case, you will need to use the services of exchanges. You will be able to find lots of them on the Internet without any problems.

Direct Investment

While there is a range of projects that you can invest in using bitcoins, the simplest way to do that is to opt for direct investment, which means purchasing bitcoins. You can simply store them in your Bitcoin wallet in Canada and catch the right price.

Bitcoin ATMs in Canada

Would you like to know how to withdraw bitcoin in Canada? In this case, you will need to use ATMs. There are more than 870 bitcoin ATMs available in this country. You can easily find one in your location by using the Internet search. There are three types of such ATMs:

- ATMs that allow converting and withdrawing cash;

- Those allowing to purchase bitcoins;

- ATMs suitable for withdrawing cash and buying bitcoins.

How Do They Work

A Bitcoin ATM is a kiosk where you can purchase Bitcoins by using cash or a bank card. While they look like standard ATMs, they are not connected to your bank account but your Bitcoin wallet or exchange.

How to Use

The price of BTC depends on the current exchange rate. There is also a fee that you will pay for such services. You will need to use a QR code to withdraw your money. There will be the bitcoin ATM scanner that you will need to use to scan the QR code of your wallet address.

If you want to buy bitcoins, then you need to enter the amount that you wish to purchase, and then insert your bank card. The transaction may take a few minutes to be processed. Once that is done, you will need to check out your bitcoin wallet and confirm the transaction.

What is Bitcoin Wallet?

It is a software program used for storing Bitcoins. Such a wallet has a certain Bitcoin address. An individual can use a private key to access his or her wallet. Transactions are made between users of Bitcoin wallets using their addresses. Such a wallet comes in different types, such as desktop, web, mobile, hardware, and paper wallets.

Online Wallets

This type of wallet allows storing bitcoin on the Internet. In simple words, you can access your wallet using your browser. While such wallets are considered to be more vulnerable to cyberattacks, they are more convenient to use because you can access your wallet from any place as long as you have a stable internet connection.

How to Choose the Right Wallet

When choosing the wallet, you should consider different criteria, such as:

- Security;

- Accessibility;

- Convenience;

- Compatibilities with different operating systems;

- Number of currencies.

The Best Wallets in Canada

It may be challenging to pick the right bitcoin wallet if you do not have enough information on that. There is the list of the best wallets available for uses living in Canada:

- Ledger Nano X. It is a hardware wallet that supports 1,184 coins and can be used offline. It is well protected against future attacks and updated on a regular basis;

- Mycelium. It is an open-source mobile wallet that allows setting customer transaction fees;

- Trezor. It is a hardware wallet that you can plug into your smartphone or computer;

- Coinbase. It is a web and mobile wallet that will be suitable even for beginners;

- Exodus. It would be the best choice for desktop users, though the mobile version is also available.

How To Pay With Bitcoin

Below you will find step-by-step instructions on how you can make payments using bitcoins.

Choose a Wallet

First of all, you need to decide which wallet you need to use based on the factors that we have provided above. If you do not have much experience in this, choose a wallet suitable for beginners.

Load Your Wallet

Now you need to add some funds to your wallet. You can use the services of exchange to convert fiat money into bitcoins and deposit them into your wallet.

Find A Vendor That Accepts Cryptocurrency

Now you can make payments using bitcoins that you have in your account. There are two main ways to do that, including the following:

Option 1: Send Bitcoin To A Public Address

In this case, you need to know the Bitcoin address of the merchant. You will enter it into the relevant field of your wallet. Remember to enter the correct amount of bitcoins as well.

Option 2: Scanning a Bitcoin QR code

It is a very easy way to pay since you will only need to scan the QR code and it will enter the recipient's bitcoin address and the amount of your purchase. Simply submit the transaction and the payment will be completed.

How to pay bills with Bitcoin in Canada

It is possible to pay bills using bitcoins in Canada and other countries. In this case, you will need to use the services of various platforms or payment systems, such as Coinsfer, Bill Pay, and others. In this case, your bitcoins will be converted to Canadian dollars, so that you could pay your bills with them.

Stores that accept bitcoin

There is a range of stores that accept bitcoin for making payments. A list of some of them is provided below:

- Alternative Airlines;

- Bitcoin.Travel;

- Pembury Tavern;

- Zynga;

- PizzaForCoins.com;

- Domino's Pizza;

- Bitcoincoffee.com;

- Jeffersons Store;

- Helen's Pizza;

- Fancy.com;

- Humblebundle.com - Indie game site;

- BigFishGames.com;

- Crowdtilt.com;

- Euro Pacific;

- PSP Mollie;

- MIT Coop Store;

- SFU bookstore;

- Shopify.com;

- Naughty America;

- MovieTickets.com;

- WebJet;

- Save the Children.

How to Accept Crypto Payments

Once you have created a crypto wallet, you can start accepting payments for your business.

Accept Payments Manually

Accepting payments manually will be more time-consuming than doing that with the help of third-party services. However, no one wants to pay extra money. If you do not need to accept lots of transactions every day, you can consider doing everything yourself. In this case, you will need to generate a new address each time to complete a sale and give your customers instructions on how much they should pay.

Bitcoin Payment Processing Providers

You can opt for services from payment processing providers. You will need it if there are lots of transactions per day on your website.

Some reliable payment processing companies include:

- BitPay;

- Coinbase;

- Skrill;

- GoCoin;

- PayPal.

In this case, your transactions will be accepted automatically.

Pros and Cons of Using Crypto As A Payment Method

There are certain advantages and disadvantages to using crypto as a payment method.

- Zero chargebacks. As a merchant you will not suffer from fraud associated with chargeback;

- An opportunity to determine transaction fees. Bitcoin allows you to decide which fee you wish to pay depending on the transaction speed;

- Anonymity. This may not be a crucial factor if you sell toys for kids. Anyway, some people prefer making their purchases confidentially.

- High volatility of the bitcoin market. This means that bitcoin rates change regularly. If it decreases, you will get less money than you initially received. However, this situation may change over time;

- Lack of trust. Some people do not trust this payment method because due to anonymity it can be used for illegal purposes and because it is not regulated by any authority.

Where to Spend Bitcoin

Do you wonder where to spend bitcoin? You can use Bitcoin to make payments on various websites as well as deposit/withdraw to/from your accounts on various third-party platforms. It is available on a range of websites, such as Microsoft, Starbucks, and others. This currency is used in different industries, such as:

- Gambling;

- Retail;

- Software;

- Exchanges;

- Others.

Alternative Payment Methods

While Bitcoin is the most popular cryptocurrency, there are a few alternatives to bitcoin that you can choose from. You can compare them to decide which one will work better for you.

Bitcoin vs Litecoin

Litecoin is also a popular peer-to-peer cryptocurrency. Its transactions are conducted based on a cryptographic protocol. It was first released in 2011.

| Bitcoin | Litecoin | |

|---|---|---|

| Created | January 3, 2009 | November 7, 2011 |

| Created By | Satoshi Nakamoto | Charlie Lee |

| Average Transaction Time | 10 Minutes | 2.5 Minutes |

| Block Reward Per Block | 12.5 | 25 |

| Supply Limit | 21 Million | 84 Million |

| Market Cap. in USD | 153.9 billion | 9.7 billion |

| Value of 1 in USD | 9088.16 | 173.55 |

Bitcoin vs Ripple

Ripple or XRP is a digital asset designed for payments. It allows making transactions in a few seconds.

| XRP | Bitcoin |

|---|---|

| Currency code: XRP | Currency code: XBT or BTC |

| Price as of Feb. 11, 2021: $0.519 | Price as of Feb. 11, 2021: $47,266.715 |

| Trading volume on Feb. 11, 2021: $9,332,665,344 | Trading volume on Feb. 11, 2021: $76,929,114,112 |

| Facilitates payments between banks in different government-backed currencies. Like other currencies and cryptocurrencies, it may be traded as a speculative investment. | Provides an alternative, decentralized currency for making purchases. Like other currencies and cryptocurrencies, it may be traded as a speculative investment. |

| The XRP Ledger created 100 billion XRP all at once. | Twenty-one million bitcoin will eventually be created by forming new blocks in the blockchain. |

| An XRP consists of 1 million drops, the only subunits of the currency. | A bitcoin consists of 1,000 millibits or millibitcoins, 1 million microbits or microbitcoins, and 100 million satoshi, the smallest division of a bitcoin that can be recorded in the blockchain. |

How to cash out bitcoin in Canada?

Many Canadians wonder how to cash out bitcoin in Canada. If you wish to turn your bitcoin into real cash, then you need to use ATMs built for bitcoin in Canada. There is a large number of them available in Canada, and you can find one by making a search on the Internet.

How to spend Bitcoin in Canada?

You will only need to set up a bitcoin wallet and add some funds to it using the services of exchanges. Then you will be able to pay for services of various merchants as well as make deposits and withdraws to/from your account that you have at third-party service providers.

Who accepts bitcoin in Canada?

If you live in Canada, you will find a range of merchants that allow making payments in this cryptocurrency. They include online casinos, bookmakers, stores, and more. Just search the Internet depending on what products or services you are looking for.

How to buy Bitcoin with a credit card in Canada?

If you want to buy bitcoin in Canada with a credit card, it is possible to do that using a credit card. In this case, you will need to do the following:

- Register with an exchange or platform that allows making payments with credit cards;

- Add funds to your website by using your credit card according to the instructions of the service provider;

- Purchase Bitcoins and withdraw them to your wallet.

What is a bitcoin payment?

Bitcoin payment is a payment solution allowing customers to purchase products and services using bitcoins according to the real-time bitcoin rate. Once you launch this payment option on your website, your customers will be able to make purchases based on the current bitcoin rate.

Where can I use bitcoin in Canada?

You can use Bitcoin in Canada on a range of websites. Those include both domestic and international companies. Simply find products or services on the Internet that you can pay for using bitcoins. Also, it is possible to withdraw cash from your bitcoin wallet using special ATMs.

Where can I pay with bitcoin?

It is possible to pay using bitcoin Canada payments on various websites as well as at land-based companies. They include Wikipedia, Microsoft, AT&T, Burger King, and many others.

Guide for cryptocurrency users and tax professionals

Cryptocurrency is a relatively new innovation that requires guidelines on taxation so that Canadians are aware of how to meet their tax obligations. The Senate reviewed the issue of taxation on cryptocurrency in 2014 and recommended action to help Canadians understand how to comply with their taxes, which the Canada Revenue Agency (CRA) is doing by presenting this guide.

Tax treatment of cryptocurrency for income tax purposes

Cryptocurrency is a digital representation of value that is not legal tender. It is a digital asset, sometimes also referred to as a crypto asset or altcoin that works as a medium of exchange for goods and services between the parties who agree to use it. Strong encryption techniques are used to control how units of cryptocurrency are created and to verify transactions. Cryptocurrencies generally operate independently of a central bank, central authority or government.

The following pages outline the income tax implications of common transactions involving cryptocurrency. When we refer to cryptocurrency in this publication, we are talking about Bitcoin or other similar virtual currencies.

Basic concepts

The CRA generally treats cryptocurrency like a commodity for purposes of the Income Tax Act. Any income from transactions involving cryptocurrency is generally treated as business income or as a capital gain, depending on the circumstances. Similarly, if earnings qualify as business income or as a capital gain then any losses are treated as business losses or capital losses.

Taxpayers have to establish if a cryptocurrency activity results in income or capital because this affects the way the revenue is treated for income tax purposes. Not all taxpayers who buy and sell cryptocurrency are carrying on business activity.

When you use cryptocurrency to pay for goods or services, the CRA treats it as a barter transaction for income tax purposes. A barter transaction occurs when two parties exchange goods or services and carry out that exchange without using legal currency. For more information, please review our archived content on barter transactions.

To figure out the value of a cryptocurrency transaction where a direct value cannot be determined, you must use a reasonable method. Keep records to show how you figured out the value. Generally, the CRA’s position is that the fair market value is the highest price, expressed in dollars that a willing buyer and a willing seller who are both knowledgeable, informed and prudent, and who are acting independently of each other, would agree to in an open and unrestricted market. For example, you could choose an exchange rate taken from the same exchange broker you are using or an average of midday values across a number of high-volume exchange brokers. Whichever method you choose, use it consistently.

If you hold more than one type of cryptocurrency in a digital wallet, each type of cryptocurrency is considered to be a separate digital asset and must be valued separately. For example, a Bitcoin is valued separately from a Litecoin.

Reporting business income or capital gains from the disposition of cryptocurrency

What is a disposition?

This refers to the way you get rid of something, such as by giving, selling or transferring it. In general, possessing or holding a cryptocurrency is not taxable. But there could be tax consequences when you do any of the following:

- sell or make a gift of cryptocurrency

- trade or exchange cryptocurrency, including disposing of one cryptocurrency to get another cryptocurrency

- convert cryptocurrency to government-issued currency, such as Canadian dollars

- use cryptocurrency to buy goods or services

Is it business income or capital gain?

The income you get from disposing of cryptocurrency may be considered business income or a capital gain. In order to report it correctly, you must first establish what kind of income it is.

The following are common signs that you may be carrying on a business:

- you carry on activity for commercial reasons and in a commercially viable way

- you undertake activities in a businesslike manner, which might include preparing a business plan and acquiring capital assets or inventory

- you promote a product or service

- you show that you intend to make a profit, even if you are unlikely to do so in the short term

Business activities normally involve some regularity or a repetitive process over time. Each situation has to be looked at separately.

In some cases, a single transaction can be considered a business, for example when it is an adventure or concern in the nature of trade. Whether you are carrying on a business or not must be determined on a case by case basis. For more information, please review our archived content on an adventure or concern in the nature of trade.

Another factor in deciding if there is a business activity is the date when the business begins. If you are still setting up or preparing to go into business, you might not be considered to have started the business. You usually have to undertake significant activity that is part of your income-earning process. Any funds or property you receive before your business begins are not generally considered to be business income. Similarly, you cannot claim deductions for income tax purposes before the business begins. For more information, please review our archived content on the start of business operations.

Some examples of cryptocurrency businesses are:

- cryptocurrency mining

- cryptocurrency trading

- cryptocurrency exchanges, including ATMs

Paragraphs 9 to 32 of Interpretation Bulletin IT-479R : Transactions in securities, provide general information to help you figure out if transactions are income or capital gains. Although the discussion of income and capital in this interpretation bulletin is helpful, remember that cryptocurrencies are not Canadian securities under the Income Tax Act.

Reporting as either income or capital gain

Generally, if disposing of cryptocurrency is part of a business, the profits you make on the disposition or sale are considered business income and not a capital gain. Buying a cryptocurrency with the intention of selling it for a profit may be treated as business income, even if it’s an isolated incident, because it could be considered an adventure or concern in the nature of trade.

If the sale of a cryptocurrency does not constitute carrying on a business, and the amount it sells for is more than the original purchase price or its adjusted cost base, then the taxpayer has realized a capital gain.

Capital gains from the sale of cryptocurrency are generally included in income for the year, but only half of the capital gain is subject to tax. This is called the taxable capital gain. Any capital losses resulting from the sale can only be offset against capital gains; you cannot use them to reduce income from other sources, such as employment income. You can carry forward your capital losses if you do not have any capital gains against which to offset those losses for the year or any of the preceding three years.

For more information on capital gains, see Guide T4037, Capital Gains.

Trading cryptocurrency for another type of cryptocurrency

Generally, when you dispose of one type of cryptocurrency to acquire another cryptocurrency, the barter transaction rules apply. You have to convert the value of the cryptocurrency you received into Canadian dollars. This transaction is considered a disposition and you have to report it on your income tax return. Report the resulting gain or loss as either business income (or loss) or a capital gain (or loss).

Example 1: Business income or loss

Alice regularly buys and sells various types of cryptocurrencies. She pays close attention to the fluctuations in the value of cryptocurrencies and intends to profit from the fluctuations. Her activities are consistent with someone who is engaged in the business of day trading. In 2017, Alice sold $240,000 worth of various cryptocurrencies, which she originally purchased for $200,000. Her net profit is $40,000. Since Alice is actively trading in cryptocurrency, which is a commercial activity, she has to report business income of $40,000 on her 2017 income tax return.

Example 2: Capital gain or loss

Tim found a deal on a living room set at an online vendor that accepts Bitcoin. Tim acquired $3,500 worth of Bitcoin to buy the furniture with. By the time he bought the furniture and converted his remaining Bitcoin back into dollars, the value of Tim’s Bitcoin had increased by $500. The gain realized by Tim was on account of capital, so Tim has to report a $500 capital gain on his income tax return. However, only 50% of that capital gain is taxable.

Example 3: Trading one type of cryptocurrency for another

On July 30, 2018, Francis bought 100 units of Ethereum, which had a value of $20,600. For this purchase, Francis used 2.5061 Bitcoins, which were trading at $8,220 per unit on that day, or the equivalent of $20,600. We consider that Francis disposed of those Bitcoins. Francis originally bought those Bitcoins for $15,000 and exchanged them for 100 units of Ethereum at a value of $20,600, resulting in a capital gain. It is calculated as follows:

$20,600 [fair market value of 2.5061 Bitcoins at the time of transaction]

- $15,000 [adjusted cost base of 2.5061 Bitcoins, their original purchase price]

$5,600 capital gain taxed at 50% = $2,800 taxable capital gain

If, on the other hand, the original purchase price of the 2.5061 Bitcoins had originally been $25,000, but at the time that Francis exchanged them for 100 units of Ethereum they were worth only $20,600, he would have a capital loss. It is calculated as follows:

$20,600 [fair market value of 2.5061 Bitcoins at the time of transaction]

- $25,000 [adjusted cost base of 2.5061 Bitcoins, their original purchase price]

$4,400 capital loss × 50% = $2,200 allowable capital loss

This example assumes that the cryptocurrency in question was held as an investment on account of capital; however, if this transaction occurred in the course of conducting a business, the entire amount of $5,600 would need to be reported as income in the first transaction and the entire $4,400 would be reported as a loss in the second transaction.

Earning cryptocurrencies through mining

Cryptocurrencies are commonly acquired in two ways:

- bought through a cryptocurrency exchange

- earned through mining

Mining involves using specialized computers to solve complicated mathematical problems which confirm cryptocurrency transactions. Miners will include cryptocurrency transactions into blocks, and try to guess a number that will create a valid block. A valid block is accepted by the corresponding cryptocurrency’s network and becomes part of a public ledger, known as a blockchain. When a miner successfully creates a valid block, they will receive two payments in a single payment amount. One payment represents the creation of new cryptocurrency on the network and the other payment represents the fees from transactions included in the newly validated block. Those who perform the mining processes are paid in the cryptocurrency that they are validating.

The income tax treatment for cryptocurrency miners is different depending on whether their mining activities are a personal activity (a hobby) or a business activity. This is decided case by case. A hobby is generally undertaken for pleasure, entertainment or enjoyment, rather than for business reasons. But if a hobby is pursued in a sufficiently commercial and businesslike way, it can be considered a business activity and will be taxed as such.

Valuing cryptocurrencies either as capital property or inventory

To file your income tax return, you need to know how to value your cryptocurrencies. This depends on whether they are considered capital property or inventory. When cryptocurrencies are held as capital property, you must record and track the adjusted cost base so that you can accurately report any capital gains.

If the cryptocurrencies are considered to be inventory, use one of the following two methods of valuing inventory consistently from year to year:

- value each item in the inventory at its cost when it was acquired or its fair market value at the end of the year, whichever is lower

- value the entire inventory at its fair market value at the end of the year (generally, the price that you would pay to replace an item or the amount that you would receive if you sold an item)

You might have to use other methods of valuing inventory, depending on the type of business you have. For example, property described in the inventory of a business that is an adventure or concern in the nature of trade must be valued at the cost you acquired the property for.

You will have to compare the cost and the fair market value of each item to figure out which is lower. You then use the lower figure for each item (or each class of items if specific items are not easily separated) to calculate the total value of your inventory at the end of the year.

"Cost" as used in the phrase "cost at which the taxpayer acquired the property," means the original cost of the particular item of inventory (for example, a block of cryptocurrency), plus all reasonable costs incurred to buy that particular block of cryptocurrency.

Use the same inventory method from year to year. Please review our archived page on inventory .

For more information on valuating inventory, including the special rules for an adventure in the nature of trade, please review our archived content on this topic here.

Keeping books and records

If you acquire (by mining or otherwise) or dispose of cryptocurrency, you have to keep records of your cryptocurrency transactions. This also applies to businesses that accept cryptocurrency as payment for goods and services.

Cryptocurrency exchanges have different standards for the kinds of records they keep and how long they keep them. If you use cryptocurrency exchanges, we suggest that you export information from these exchanges periodically to avoid losing the information necessary to report your transactions. You are responsible for keeping all required records and supporting documents for at least six years from the end of the last tax year they relate to.

You should maintain the following records on your cryptocurrency transactions:

- the date of the transactions

- the receipts of purchase or transfer of cryptocurrency

- the value of the cryptocurrency in Canadian dollars at the time of the transaction

- the digital wallet records and cryptocurrency addresses

- a description of the transaction and the other party (even if it is just their cryptocurrency address)

- the exchange records

- accounting and legal costs

- the software costs related to managing your tax affairs.

If you are a miner, also keep the following records:

- receipts for the purchase of cryptocurrency mining hardware

- receipts to support your expenses and other records associated with the mining operation (such as power costs, mining pool fees, hardware specifications, maintenance costs, and hardware operation time)

- the mining pool details and records

Please note that different types of software are available to track cryptocurrency trades and maintain records. The CRA does not endorse any particular software, so choose the type of software that is best for you to help with your record keeping.

For more information, please review our link on keeping records.

How does the GST/HST apply to cryptocurrency?

Where a taxable property or service is exchanged for cryptocurrency, the GST/HST that applies to the property or service is calculated based on the fair market value of the cryptocurrency at the time of the exchange.

If your business accepts cryptocurrency as payment for taxable property or services, the value of the cryptocurrency for GST/HST purposes is calculated based on its fair market value at the time of the transaction.

Keep all records that show how you calculated the fair market value.

Digital currency

This page is about cryptocurrencies, which are not issued or governed by a government or central bank.

Digital currency is electronic money. It's not available as bills or coins.

Cryptocurrencies are a type of digital currency created using computer algorithms. The most popular cryptocurrency is Bitcoin.

No single organization, such as a central bank, creates digital currencies. Digital currencies are based on a decentralized, peer-to-peer (P2P) network. The “peers” in this network are the people that take part in digital currency transactions, and their computers make up the network.

Using digital currencies

You can use digital currencies to buy goods and services on the Internet and in stores that accept digital currencies. You may also buy and sell digital currency on open exchanges, called digital currency or cryptocurrency exchanges. An open exchange is similar to a stock market.

To use digital currencies, you need to create a digital currency wallet to store and transfer digital currencies. You can store your wallet yourself or have a wallet provider manage your digital currency for you.

You need a “public key” and a “private key” to use your wallet. Keys are made up of a random sequence of numbers and letters.

Public keys are used to identify your wallet.

Private keys are used to unlock your wallet and access your money. Private keys should be kept secret.

All transactions are recorded to a public ledger or “blockchain” that everyone can see.

Digital currencies are not a legal tender

Digital currencies, such as Bitcoin or other cryptocurrencies, are not legal tender in Canada. Only the Canadian dollar is considered official currency in Canada.

The Currency Act defines legal tender.

Legal tender is defined as:

- bank notes issued by the Bank of Canada under the Bank of Canada Act

- coins issued under the Royal Canadian Mint Act

Digital currencies are not supported by any government or central authority, such as the Bank of Canada.

Financial institutions, such as banks or credit unions, don't manage or oversee digital currency.

Automated exchangers (Bitcoin ATM s)

Unlike traditional ATMs, they are not connected to your bank, credit union or the Interac network. You may be charged a transaction fee for using a Bitcoin ATM. Shop around as exchange fees vary and you may be able to get lower rates elsewhere.

Generally, when you use a Bitcoin ATM, the machine:

- reads the bills you insert

- converts the amount into an amount of bitcoins

- sends the equivalent of bitcoins to the Bitcoin address you enter

How tax rules apply to digital currency

Tax rules apply to digital currency transactions, including those made with cryptocurrencies. Using digital currency does not exempt consumers from Canadian tax obligations.

This means digital currencies are subject to the Income Tax Act.

Buying goods or services using digital currency

Goods purchased using digital currency must be included in the seller’s income for tax purposes. GST /HST also applies on the fair market value of any goods or services you buy using digital currency.

Buying and selling digital currency like a commodity

When you file your taxes you must report any gains or losses from selling or buying digital currencies.

Digital currencies are considered a commodity and are subject to the barter rules of the Income Tax Act. Not reporting income from such transactions is illegal.

Risks of using digital currency

Using digital currency has certain risks.

You may have fewer protections

You may not have access to a complaint-handling process like you would with other payment methods, such as debit and credit cards.

Even if you use a wallet provider to help you manage your digital currency, the provider does not have to help you get your funds back if something goes wrong with your transaction.

Your deposit is not insured

It's your responsibility to protect your digital currency wallet.

Federal or provincial deposit insurance plans don't cover digital currency.

For example, the Canada Deposit Insurance Corporation only covers eligible deposits in Canadian dollars at member financial institutions if the institution fails.

If the currency exchange or wallet provider that has your digital currency fails or goes bankrupt, your funds won't be protected.

Your investment may be high risk

Digital currencies can be risky investments because their value can change quickly. The value of a digital currency can increase or decrease over a very short period of time. Such changes in value can be difficult to predict.

When you exchange your digital currency for traditional currency, such as the Canadian dollar, it may be worth less than when you bought it.

You may have a hard time exchanging your digital currency

Digital currencies can be difficult to buy and use. You may not be able to exchange them easily for cash or to purchase goods and services.

Merchants don't have to accept digital currencies as payment. They don't have to exchange digital currencies for traditional currencies, such as the Canadian dollar.

You may be exposed to fraud

Digital currencies may be vulnerable to fraud, theft and hackers.

All transactions are recorded to a public ledger or “blockchain”. The blockchain may include information such as transaction amounts, wallet addresses and the public keys of the sender and recipient.

Digital currencies are also sometimes used to support illegal activities.

Transactions are not reversible

Purchases and transactions made with digital currencies are not reversible.

- you can’t reverse the charges if you didn’t receive the product

- you can’t get your money back unless the seller agrees

- you might not be able to stop a payment

Tips for using digital currency

Here are a few tips to help you protect yourself when using digital currency.

Protect your wallet

Take steps to protect your wallet:

- keep your wallet, and any backups, in a safe place

- encrypt your wallet using encryption software

- encrypt any copies you make or online backups

- set a password to help prevent thieves from withdrawing your funds

- use a strong password that contains letters, numbers and symbols

Know the merchant’s refund, return and dispute policies

Before you make a purchase, find out:

- what the exchange rate will be

- if refunds are available

- if refunds will be processed in digital currency, Canadian dollars or store credit

- how to contact someone if there’s a problem

Wait for multiple confirmations before completing a transaction

It can take 10 minutes or more for a digital currency transaction to be confirmed. Confirmation happens when users on the network verify the transaction. During that time, a transaction could be reversed and you could lose your funds to a dishonest user.

Understand what the actual costs will be

Find out if there are any mark-ups or other fees. Find out what will happen if the rate changes before the exchange is completed.

Think about the future

Consider what will happen if you fall ill or die and can no longer access your wallet.

If no one knows the locations and passwords of your wallets when you are gone, the funds can’t be recovered.

Consider having a backup plan for your peers and family.

Regulation of Cryptocurrency: Canada

Canada allows the use of digital currencies, including cryptocurrencies. However, cryptocurrencies are not considered legal tender in Canada. Canada’s tax laws and rules, including the Income Tax Act, also apply to cryptocurrency transactions. The Canada Revenue Agency has characterized cryptocurrency as a commodity and stated that the use of cryptocurrency to pay for goods or services should be treated as a barterВ transaction.

On June 19, 2014, the Governor General of Canada gave his royal assent to Bill C-31, which includes amendments to Canada’s Proceeds of Crime (Money Laundering) and Terrorist Financing Act. В The new law treats virtual currencies as “money service businesses” for purposes of anti-money laundering provisions. The law is not yet in force, pending issuance of subsidiary regulations.

I.В Legality of Cryptocurrencies

Canada allows the use of cryptocurrencies.[1] According to the Government of Canada webpage on digital currencies, “[y]ou can use digital currencies to buy goods and services on the Internet and in stores that accept digital currencies. You may also buy and sell digital currency on open exchanges, called digital currency or cryptocurrency exchanges.”[2] However, cryptocurrencies are not considered legal tender in Canada.[3] According to the Financial Consumer Agency of Canada, “[o]nly the Canadian dollar is considered official currency in Canada.” The Currency Act[4] defines “legal tender” as “bank notes issued by the Bank of Canada under the Bank of Canada Act” and “coins issued under the Royal Canadian Mint Act.”[5]

II. В Taxation

Canada’s tax laws and rules also apply to digital currency transactions.[6] The Canada Revenue Agency (CRA) “has characterized cryptocurrency as a commodity and not a government-issued currency. Accordingly, the use of cryptocurrency to pay for goods or services is treated as a barterВ transaction.”[7]

A.В Payments in Cryptocurrencies

Digital currencies are subject to the Income Tax Act (ITA).[8] According to the Financial Consumer Agency of Canada “[g]oods purchased using digital currency must be included in the seller’s income for tax purposes.”[9] On the issue of taxation, the Canada Revenue Agency addsВ that,

[w]here digital currency is used to pay for goods or services, the rules for barter transactions apply. A barter transaction occurs when any two persons agree to exchange goods or services and carry out that exchange without using legal currency. For example, paying for movies with digital currency is a barter transaction. The value of the movies purchased using digital currency must be included in the seller’s income for tax purposes. The amount to be included would be the value of the movies in Canadian dollars.[10]

The Canada Revenue Agency has also said that “GST/HST [Goods and Services Tax/ harmonized sales tax] also applies on the fair market value of any goods or services you buy using digitalВ currency.”[11]

B.В Trade in Cryptocurrencies

As noted, digital currency is characterized as a commodity under Canadian law. Thus, according to the Financial Consumer Agency “[w]hen you file your taxes you must report any gains or losses from selling or buying digital currencies.”[12] Any resulting gains or losses “could be taxable income or capital for the taxpayer.”[13] The CRA has published a bulletin[14] to “provide information that can help in determining whether transactions are income or capital in nature.”[15] According to lawyers from the law firm Gowling WLG,

[i]n general terms, where a taxpayer does not engage in the business of trading in cryptocurrency (i.e., the taxpayer acquires such property for a long-term growth), any gain or loss generated from the disposition of cryptocurrency should be treated as on account of capital. However, where a taxpayer engages in the business of trading or investing in cryptocurrency, gains or losses therefrom should be treated as being on account of income. The cost to the taxpayer of property received in exchange for cryptocurrency (for example, another type of cryptocurrency) should be equal to the value of the cryptocurrency given up as consideration.[16]

The law firm also notes that “it is possible that a trader in cryptocurrency would also be required to collect GST/HST (and QST [Quebec Sales Tax]) on their supplies, but the CRA has not expressed a clear view on this point.”[17]

C.В Mining Cryptocurrencies

Mining of cryptocurrencies can be undertaken for profit (as a business) or as a personal hobby (which is nontaxable).[18] According to Gowling WLG,

[i]f the taxpayer mines in a commercial manner, the income from that business must be included in the taxpayer’s income for the year. Such income will be determined with reference to the value of the taxpayer’s inventory at the end of the year, established pursuant to the rules in section 10 of the ITA and Part XVIII of the Regulations regarding valuing inventory.[19]

III. В Anti-Money Laundering Regime

On June 19, 2014, the Governor General of Canada gave his royal assent to Bill C-31 (An Act to Implement Certain Provisions of the Budget Tabled in Parliament on February 11, 2014, and Other Measures),[20] which includes amendments to Canada’s Proceeds of Crime (Money Laundering) and Terrorist Financing Act. The law treats virtual currencies, including Bitcoin, as “money service businesses” for purposes of anti-money laundering laws.[21] As a result of the law, companies dealing in virtual currencies are required to register with the Financial Transactions and Reports Analysis Centre of Canada (Fintrac), put into effect compliance programs, “keep and retain prescribed records,” report suspicious or terrorist-related property transactions, and determine if any of their customers are “politically exposed persons.”[22] The law will also apply to virtual currency exchanges operating outside of Canada “who direct services at persons or entities in Canada.”[23] The new amendments also bar banks from opening and maintaining accounts or having a “correspondent banking relationship” with companies dealing in virtual currencies, “unless that person or entity is registered with the Centre.”[24]

The law is regarded as the “world’s first national law on digital currencies, and certainly the world’s first treatment in law of digital currency financial transactions under national anti-money laundering law.”[25] Though the law has received royal assent it is not yet in force, pending issuance of subsidiary regulations. Recent news reports indicate that the government may be about to issue those regulations.[26]

IV. В Securities Law

On August 24, 2017, the Canadian Securities Administrators (CSA) published CSA Staff Notice 46-307 Cryptocurrency Offerings,[27] “which outlines how securities law requirements may apply to initial coin offerings (ICOs), initial token offerings (ITOs), cryptocurrency investment funds and the cryptocurrency exchanges trading these products.”[28] On February 1, 2018, the Globe and Mail reported that the Ontario Securities Commission had approved the country’s first blockchain fund—Blockchain Technologies ETF.[29]

V. В Bank of Canada’s Blockchain Project

The Bank of Canada, Payments Canada, and R3, a distributed database technology company, are involved in a research initiative called Project Jasper “to understand how distributed ledger technology (DLT) could transform the wholesale payments system.”[30] Phases 1 and 2 of the project are “focused on exploring the clearing and settlement of high-value interbank payments using DLT” and have been completed. Phase 1 of Project Jasper used the Ethereum platform as the basis for the DLT, while Phase 2 used the “custom-designed R3 Corda platform.”[31]

In June 2017, the Bank of Canada published a report on its preliminary findings from Phase 1 of Project Jasper and partly found that “[f]or critical financial market infrastructures, such as wholesale payment systems, current versions of DLT may not provide an overall net benefit relative to current centralized systems.”[32] On September 29, 2017, the Bank of Canada, Payments Canada, and R3 released a white paper that describes the project’s findings to date.[33] On October 17, 2017, Payments Canada, the Bank of Canada, and TMX Group announced “a new collaboration to experiment with an integrated securities and payment settlement platform based on distributed ledger technology (DLT) as part of the third phase of the Project Jasper researchВ initiative.”[34]

Prepared by Tariq Ahmad

Foreign Legal Specialist

June 2018

New from Bitvo

Home / Education / Articles / How you can buy Bitcoin in Canada

How you can buy Bitcoin in Canada

You may have heard about crypto from a friend or in the press. The names Bitcoin, Ethereum, and XRP are common. There are many other cryptocurrencies and tokens, but Bitcoin is the biggest by market cap. It’s also the oldest.

Cryptocurrency represents the next generation of finance. Bitcoin is the granddaddy of the space, and it’s where all the other 6,000 plus crypto projects got their inspiration from.

So if you’re looking to get involved in cryptocurrency, what do you need to know?

By the time you’re done reading, you’ll know the why, what, where, and how to buy Bitcoin in Canada.

Here’s what we will be covering:

Why Bitcoin

What can you do with Bitcoin?

Where to buy bitcoin in Canada

Canadian cryptocurrency exchanges have rules.

How to choose the right crypto exchange to buy Bitcoin

How do I sign up?

What ID is required?

How can I deposit money?

How does Bitvo store cryptocurrencies?

What is a wallet, and how do I choose one?

What are some crypto security best practices?

How do I buy Bitcoin?

What is a satoshi?

How do I convert BTC to CAD?

How do I access my cash after I sell BTC?

How do I trade Bitcoin?

What the next step?

Why Bitcoin

Your view on Bitcoin depends on what you have heard and believe. It has been called money, a payment system, a hedge against inflation. It’s protection against failing monetary systems. It has also been called speculative and an investment.

Bitcoin is all of those things, but it is also a vote about the future of finance that is open to anyone.

Like most of crypto, Bitcoin connects with the financial system but exists outside and independent of it. This provides buyers and owners with financial democracy.

You can move money or value in and out of the traditional system into the Bitcoin network easily and at low cost.

Bitcoin is not issued or controlled by any government. Founded in 2009, it also has a fixed number of units at 21 million, with 18 million issued so far.

What can you do with Bitcoin?

You can do several things with Bitcoin.

You can buy some as a vote for this new form of money and financial system.

You can buy and hold (or hodl) some as a form of financial asset.

You can trade Bitcoin actively as a day trader, market maker, swing trader, or portfolio manager through a cryptocurrency exchange.

You can buy BTC with CAD and move your BTC to an altcoin exchange to participate in various other speculative altcoin and token projects.

You can use them to buy consumer goods.

You can lend BTC to other traders for a fee.

You can move money from one person to another cheaply, quickly, and easily.

You can sell Bitcoin and convert it to various fiat currencies like CAD or a stablecoin like QCAD.

Where to buy bitcoin in Canada

If you want to buy cryptocurrency, depending on the project, there are some different ways to acquire it.

For Bitcoin, you can receive it from another party on the peer to peer network in exchange for a good or service.

You can buy BTC at a Bitcoin ATM which are located worldwide, but also typically have high fees.

Or you can buy Bitcoin on an exchange, which is where most people gain access to it.

Canadian cryptocurrency exchanges have rules

The exchange business in Canada and around the world has been transformed in recent years.

New regulations require crypto exchanges in Canada to register as Money Services Businesses with FINTRAC. As a part of that regulation, Canadian crypto exchanges also require their clients to complete valid KYC/AML (know-your-client / anti-money laundering) documentation.

These steps help protect the market and the exchange from bad actors and stem the movement of stolen crypto coins.

How to choose the right crypto exchange to buy Bitcoin

When choosing a Canadian crypto exchange to buy Bitcoin or another cryptocurrency in Canada, there are a few things you should look for.

Take a look at the founders and executives. Are they transparent with their backgrounds and experience? And do they have a demonstrated track record of working with other people’s money in a regulated environment?

Security is a key element of crypto, and you should look for the following:

- * Air-gapped cold storage

- * Annual security audits by 3rd party security specialists

- * Multiple signatories

Access to your fiat and digital assets should be flexible and easy. Look for the following:

- * Full reserve basis so that your funds are always your funds

- * A time-specific guarantee for access to your funds

- * The backing of and or access to a Tier 1 regulated financial institution

- * A cash card to give you more flexibility

If you are trading or thinking about trading Bitcoin or other digital assets on a Canadian crypto exchange, look for the following:

- * Proprietary technical analysis tools to assist in your trading strategy

- * Educational material designed to help you trade better and learn faster

- * Live 24/7 support team

Bitvo was founded by fintech, financial, and payment experts and designed to provide Canadians with all of these important elements and security features.

How do I sign up?

To sign up to Bitvo, you simply go to the Register button, and follow the instructions. It’s typically fast and easy to get set up.

You can download the IOS, and Android versions on the App Store or Google Play to use the mobile app.

What ID is required?

During the signup process, you will be asked for basic information like your address and other specific details. These are used to verify your identity, which is required by regulation in Canada.

Every registered Canadian cryptocurrency exchange is required to follow these procedures.

Typically, initial verification is instantaneous. In rare cases, you may be asked additional questions to verify your identity. If additional information is required to verify your identity, you can do this at a physical Canada Post location.

We can have Canada Post physically verify your ID based on our relationship with a tier 1 Canadian financial institution.

Registrations for non-Canadians may take more time, given the requirements and various guidelines that dictate how we can validate your identity. And registration may not be available in your country of residence.

As soon as you are verified, you can deposit, trade, and withdraw from your Bitvo account.

How can I deposit money?

You can fund your Bitvo account via cash, Interac, Interac eTransfer, wire transfer, or by depositing cryptocurrency.

If you make an e-Transfer deposit to your Bitvo account, there is a five-day hold from the time of the deposit of CAD and cryptocurrency withdrawals. This hold may be waived under certain circumstances.

Each funding method has a different limit, and aside from Canada Post Load, all deposits are free. You can find out more about each method’s limits on our fees page.

How does Bitvo store cryptocurrencies?

Bitvo uses state-of-the-art hot and cold wallet storage. Cryptocurrencies held in hot wallet storage is always minimized to reduce the risk of losses.

Hot wallet storage is contracted from BitGo, one of the world’s first and largest cryptocurrency wallet providers.

95% and up to 100% of the cryptocurrencies traded on the Bitvo Exchange are secured in cold storage.

Bitvo follows best-in-class cold storage policies and procedures. These include utilizing offsite, third party, air-gapped cold storage that is only accessible with multiple signatures.

What is a wallet, and how do I choose one?

Buying Bitcoin and other cryptocurrencies and digital assets requires storage. Your storage options off-exchange are referred to as wallets.

There are a variety of wallet options for your Bitcoin and crypto assets.

- * Hardware wallets

- * Paper wallets

- * Desktop wallets

- * Mobile wallets

- * Online wallets

Each method has its pros and cons. Farshad Abasi of Forward Security recommended using a combination of wallet options for extra security. For example, a hardware wallet and a paper wallet backup.

For a more in-depth explanation of various wallets, you can see our comprehensive article on wallets here.

With digital currencies, wallets are important, but so is security.

What are some crypto security best practices?

Cyber thieves are working overtime to get access to your phone and computer. They want access to your bank accounts and crypto keys.

There are a few important steps you can take to protect yourself.

- * Avoid sharing important personal details online

- * Use a dedicated, “clean,” secure computer for financial activities

- * Avoid downloading apps and extensions from unknown third parties

- * Pause before clicking on any link

- * Don’t click on unusual texts or email links

- * Don’t modify your phone

- * Don’t jailbreak your phone

- * Use two-factor authentication

Farshad Abasi and Dominic Vogel shared their security tips and expertise on how crypto buyers, holders, and traders can protect themselves.

How do I buy Bitcoin?

Once your account is set up, you simply go your trading screen. The screen gives you direct market access to buy and sell Bitcoin and other digital assets like ETH, XRP, DASH, and QCAD.

At Bitvo, you can do this from the Buy & Sell menu or in the Advanced Trading view.

In Advanced Trading view, pick your asset, a custom price, and select an order type.

Using the Buy & Sell menu allows you to select the amount of cryptocurrency you wish to buy at the market rate. You can buy a full Bitcoin or whatever amount of satoshi’s you want.

There are no trading or maker-taker fees on Bitvo when you trade Bitcoin, ETH, XRP, or any other cryptocurrencies listed.

What is a satoshi?

You don’t have to buy a full Bitcoin. Each Bitcoin is divisible into smaller units allowing you to buy any fractional amount you wish.

One Bitcoin can be divided up to 8 decimal places.

So one Bitcoin is equal to 100,000,000 units, called satoshis or SAT.

How do I convert BTC to CAD?

If you sell your BTC on a Canadian cryptocurrency exchange, the process is straightforward.

To sell your Bitcoin or convert it back to CAD or to the Canadian stablecoin QCAD, you simply deposit it in your Bitvo account and go to the Buy & Sell menu, or use your Advanced Trading view.

If you are trying to sell your BTC for CAD on an international crypto-exchange, check to see if they offer a BTC/CAD pair.

How do I access my cash after I sell BTC?

Bitvo provides all of its clients with exclusive access to the Bitvo Cash Card. The Bitvo Cash Card allows you to access your cash instantly at any ATM. Or if you prefer, you can use it to make purchases wherever Visa® or Plus are accepted.

Refer to our fees page for charges and fees associated with withdrawals or the Bitvo Cash Card page for more details.

How do I trade Bitcoin?

If you’ve decided you want to do more than buy and hold, you can trade Bitcoin instead.

Trading has various styles and approaches, like day trading, swing trading, position trading, etc. It’s important to figure out which trading style suits your personality.

Trading involves a variety of skills, including risk management, developing a trading plan, and analysis. Most people who trade Bitcoin use technical analysis, and there are many different ways to use technical analysis to trade. However, the most important thing to remember about trading Bitcoin with technical analysis is to keep it simple. More indicators aren’t necessarily better.

Bitvo has developed a proprietary technical analysis tool to provide you with added technical insights. It combines numerous technical indicators and uses advanced machine learning to provide technical scores and insights. This tool can compliment other manual technical analysis services you may use like tradingview.com.

Bitvo has also invested in an extensive trading education content library to help you get better, faster. You can read about technical analysis and many other elements of trading in our extensive education section.

What is the next step?

Bitcoin is an important new technological breakthrough in money, asset transfer, and fintech. Whether you buy, sell, or hold Bitcoin or assets like ETH, XRP, DASH, QCAD, and others, you can do it in your own way.

Trading on a Canadian cryptocurrency exchange has advantages over international crypto exchanges. These include registration as a Money Services Business and the ability to quickly and easily convert to CAD from BTC or ETH.

The Bitvo Exchange has a state of the art cryptocurrency exchange platform that is fast, easy, and secure. It is founded by financial professionals with backgrounds in fintech, payments, and banking for Canadians.

Trades on the Bitvo Exchange are free, with no maker, taker fees. Deposits like wire transfers and eTransfers are also free. And clients get exclusive access to the Bitvo Cash Card and the Bitvo Same Day Guarantee.

If you’re ready to get started, you can sign up below to start trading today.

Ready to get started? Begin trading today.

Questions? We’re here 24/7.

Get in touch with our support team.

Chat with us

Start an online chat to get instant answers to your questions.

Email Us

Send us an email, and we’ll get back to you right away.

Call Us

Our support team is standing by to take your call.

So, let's define, what was the most valuable conclusion of this review: Interested in Bitcoin trading? Read this essential guide to getting started with Bitcoin trading in Canada first and get a preview of Wealthsimple Crypto. at Bitcoin Basics to Know in Canada

Contents of the article

- A Guide on How to Start Trading Bitcoin...

- Bitcoin Storage