This site was created specifically for people from Canada, for quick acquaintance with the gambling industry online. In today's article, you can know all about 5, things, you, didnt, know, cryptocurrency, 5 things you didnt know cryptocurrency. Our Canadian visitors have asked us so many times to write the review of "5 Things You Didn t Know About The Duchess Of Cambridge, 5 Things You Didn't Know About Cryptocurrency in Canada" because of high interest in this topic. Well, the thorough investigation by our gambling expert had been already finished and we have collected here all useful information about 5, things, you, didnt, know, cryptocurrency, 5 things you didnt know cryptocurrency in one review. You may read it now!

5 Things You Didn't Know About Cryptocurrency in Canada

Continue reading to know more! Cryptocurrency is a form of currency, but instead of having a physical form, such as cash or a debit card, it exists as an internet-based medium and uses cryptographic functions to conduct a transaction. Cryptocurrency is digital money which can be used to buy goods and services. It exists online which means it doesn ’t appear in physical coins or bills. 2. Bitcoin is the first cryptocurrency and was created in January by a mysterious person or group known as.

5 Things You Didn't Know About The Duchess Of Cambridge

5 Things You Didn’t Know About Montgomery. Allison Kay. Published: Janu. Italika. Share on Facebook; Share on Twitter; I love putting the spotlight on little towns throughout the Hudson Valley. The history behind each unique village tells a specific story. I bought my sister a few books about local, historic towns and it was so. But don't go thinking that's all there is to know about her; we got her to reveal a few things that might surprise you once again. She had a crush on 7th Heaven creator Aaron Spelling's son. There's more to icebergs than just "Titanic" references. Learn about these captivating ocean objects in this video. Expedition of the JOIDES Resolution t. You may already know about his laundry list of controversial statements, too. But here's a list of five things that you probably didn't know about Donald Trump 5 . Ahead of ‘Funky’s’ return to combat sports, let’s take a look at 5 things you probably didn’t know about MMA legend Askren. 1. Ben Askren didn’t start wrestling until 6th grade ‘Funky’ is one of the best wrestlers to grace the sport of MMA. But, it .

5 Things You Didnt Know Cryptocurrency

Now that you know what cryptocurrency and blockchain is, there are many ways that it is applicable. Here are few of the most important things to consider: 1. The U.S. treats cryptocurrency like property. As regulated by the IRS, the value of cryptocurrency must be reported with the fair market value at payment or receipt in U.S. dollars. One of. Meanwhile, here are five things you didn’t know about cryptocurrency: 1.

Cryptocurrency is digital money which can be used to buy goods and services. It exists online which means it doesn’t appear. Meanwhile, here are five things you didn’t know about cryptocurrency: 1. Cryptocurrency is digital money which can be used to buy goods and services. It exists online which means it doesn ’t appear in physical coins or bills.

Whether you are simply a collector waiting for value to increase, or you prefer to use cryptocurrency for buying and selling, your investment might carry some risk. That risk could prove to be worthwhile, but with the list of things you didn't know about cryptocurrency now a lot shorter, that's a risk for you to judge! 5 Things You Probably Didn't Know About Americans Who Hold Cryptocurrencies. They're older than you think. If you thought all cryptocurrency holders were young, wide-eyed Millennials, you Author: Ron Shevlin.

To confirm your email address you must click the link in the email we have sent you. Please check your junk folder if you do not see our email in your inbox. Join today to claim our exclusive sign up bonuses! Get all the latest casino bonuses, reviews and more. Sign Up. Cryptocurrency is all the rage in the investing world these days.

Five Things You Didn't Know About Jeremy Irvine

It has entire segments dedicated to it on the news, in magazines, on finance websites and more, and everyone seems to think it’s the “new new” when it comes to building wealth. “Cryptocurrency is super trendy these days. It’s worth looking at, but it’s Cryptocurrency: 5 Things You Need to Know Read More». In today's article, you’ll find a list of ten random items you didn’t know cryptocurrency could buy.

Continue reading to know more! Cryptocurrency is a form of currency, but instead of having a physical form, such as cash or a debit card, it exists as an internet-based medium and uses cryptographic functions to conduct a transaction.

Meanwhile, here are five things you didn't know about cryptocurrency: 1.

5 Things You Didn’t Know About Naomi Osaka | Vogue

Cryptocurrency is digital money which can be used to buy goods and services. It exists online which means it doesn ’t appear in physical coins or bills. 2. Bitcoin is the first cryptocurrency and was created in January by a mysterious person or group known as.

The cryptocurrency market, which consists of bitcoin and several other major digital currencies, 3 Important Things to Know About Bitcoin.

5 Things You Didn't Know Your Tablet Can Do | Fox News

. With a growing global community of cryptocurrency investors, knowing how to navigate the market will be key to your success. In this article, we’re going to reveal 5 things you might not know about bitcoin and why this cryptocurrency is on course for a profitable and sustainable future. 7 Things You May Not Know About The History of Cryptocurrency by Rocky Darius | While cryptocurrencies and blockchain technology are exploding in the eyes of the world, there’s still a lot we don’t know about the history of the digital asset know as cryptocurrencies.

1. Anyone Can Make Their Own Cryptocurrency. You can write a blockchain and use it to create your own digital currency. All you need is time, some money, and a team of people who can to code. However, the low barrier entry to cryptocurrency possesses a great threat to blockchain and the value of the already well-established digital currencies.

2. 4 Facts You Didn't Know About Cryptocurrencies If you think that the cryptocurrency market is made of just bitcoin, Ethereum, and a handful of others, think again. As of this writing, there.

Cryptocurrency is the fastest growing trend in technological and financial circles today. Find out what you need to know about cryptocurrencies right now. Cryptocurrency, What You Need To Know Right Now. It is without a doubt that cryptocurrency is the hottest trend in.

2 days ago Re: Five Things You Didn’t Know About Bitcoin, Other Cryptocurrencies by femijay(m): pm On Feb 06 Dorlarphor Do you know with the new CBN policy, you will not be able to deposit Naira to exchange for crypto again but the good news is that we have PayPal. 5 Facts You Didn't Know About Ripple Find out about this up-and-coming cryptocurrency.

Imagine you entered a place where you know nothing about it. At that time, you played a gamble, in which you might discover a great place or you can count it in your bad experiences. So, a little research is all you need before entering a new world.

Here, we are writing about 5 things you should know before entering the Cryptocurrency world. 1. 5 things you didn’t know about blockchain.

Fraud-resistant and almost unhackable, here is how blockchain is starting to deliver on its buzz. In Brief. A blockchain is a string of unique digital information stored across a network of computers. This is not a cryptocurrency in the style of Bitcoin. It is akin to a secure contract exchange. 28 things you didn't know you could buy with bitcoins.

We're talking seriously awesome stuff here, from alternative comics to yachts. InMason Borda, now the CEO of the cryptocurrency. 3 Things You Didn’t Already Know About Cryptocurrency Aug / in Personal Finance / by Kenneth W.

Boyd If you’re into stocks or investments at all, it’s hard to ignore the impact that cryptocurrency has had on the market in recent years.

Libra cryptocurrency will be a stablecoin, as claimed by Facebook. Thus Libra holders can be sure that the value of their assets won’t blur or disappear over time. Libra cryptocurrency value will be tied to a basket of short-term government securities based on international currencies, such as the dollar, pound, euro, and others. 3. Libra’s. Windows 10 is the most sophisticated and feature-rich OS from Microsoft.

When it was first released, there were some very new features, and then there were those polished ones. Overall, it’s one of the best efforts by Microsoft, but you’ll be surprised to learn a few things you probably didn’t know. Five Things You Didn’t Know About Bitcoin, Other Cryptocurrencies. Following the ban on cryptocurrency trading, the Central Bank of Nigeria has ordered banks and financial institutions to block bank accounts trading in cryptocurrency, stressing that failure to comply to the directive attracts severe regulator sanctions.

The cryptocurrency pairs themselves are unique. To help you understand cryptocurrency as a commodity and how you can enter the market through mainstream brokers, here are five things you need to know about cryptocurrency pairs. They Make Trading Easy. When you see a cryptocurrency pair, you are basically seeing an exchange between the two coins. 4 Facts You Didn't Know About Cryptocurrencies. Publisher. The Motley Fool. Published. AM EDT. as well as a couple other cryptocurrency facts you may be interested to know.

The Grayscale Bitcoin Trust (OTC: GBTC) traded higher by another % on Tuesday as the price of bitcoin soared above $46, following news that Tesla Inc (NASDAQ: TSLA) bought.5. Five Things You Didn’t Know About Bitcoin, Other Cryptocurrencies Nigeria is the latest country to ban cryptocurrency trading as announced on Friday by the Central Bank of Nigeria. The CBN ordered banks and financial institutions to block bank accounts trading in cryptocurrency, stressing that failure to comply to the directive attracts.

Related: 5 things you didn't know about Patrick Mahomes (that make him so normal) Only time will tell. For now, let’s go over five things you might not have known about Brady. 5 Things You Didn’t Know You Could do on a Cruise. Here are five exciting activities a cruise ship offers today that match the pace with the demands of a new-age world traveller.

3 Surprising Things You Didn’t Know About Bitcoin

Bitcoin’s impressive price rise has made headlines over the last several months. Here’s a look at three things investors might not know about the cryptocurrency.

- Is Bitcoin Here to Replace Gold?

- VIDEO — John Wu, Ava Labs: Bitcoin is Gold for Millennials

- 3 Surprising Things You Didn’t Know About Bitcoin

- Bitcoin: A Brief Price History of the First Cryptocurrency

- 5 Ways to Invest in the Accelerating Bitcoin Market

- Bitcoin ETFs: The Latest Way to Access the Crypto Market

- Bitcoin Trusts: An Easy Way to Enter a Complicated Market

Despite being one of the most in-demand assets of 2020, there is still a lot of mystery surrounding bitcoin and cryptocurrencies in general.

Rising from US$4,000 in March 2020 to more than US$57,000 in February 2021, bitcoin has soared 1,175 percent, topping out with a market cap of more than US$1 trillion.

The rapid rally prompted investment bank Citigroup (NYSE:C) to state that bitcoin has hit a watershed moment that may result in it becoming the currency of global trade.

NEW! Gold vs Bitcoin. A Fight For The Future.

Our FREE Outlook Report Will Provide You With EXCLUSIVE Content Such As Expert Advice, Trends, Forecasts and More!

“There are a host of risks and obstacles that stand in the way of bitcoin progress,” Reuters quotes the bank as saying in early March. “But weighing these potential hurdles against the opportunities leads to the conclusion that bitcoin is at a tipping point.”

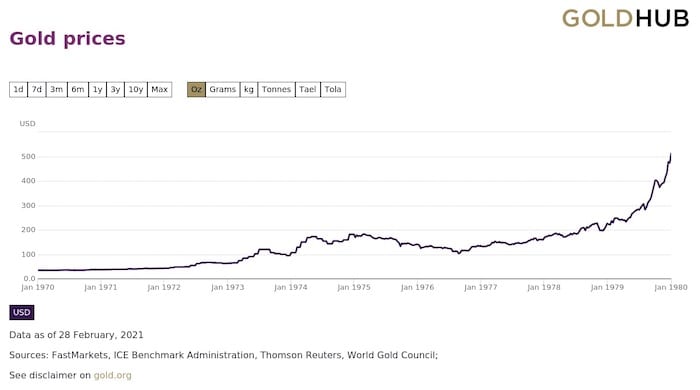

Last November, the American bank projected that bitcoin could reach US$300,000 by December 2021. It called the digital cash the “new gold,” comparing its performance to that of the yellow metal in the 1970s.

Gold price performance, 1970 to 1980. Chart via the World Gold Council.

Between January 1, 1970, and January 1, 1980, the value of gold rocketed 1,326 percent, rising from US$35.17 per ounce to US$512.

With bitcoin mimicking some of the trends that have benefited gold in its ascent to record territory (US$2,063 in August 2020), the Investing News Network took a look at some of the lesser-known things regarding this emerging asset class. Read on to learn more.

1. Bitcoin is not legal tender

One of the hindrances to bitcoin’s early growth was the ability to actually spend it anywhere. While the tech savvy sang the praises of the digital money, most were confused as to what they would do with it.

Now the list of companies that accept bitcoin as payment is beginning to grow, reaching the likes of Microsoft (NASDAQ:MSFT), Tesla (NASDAQ:TSLA), Visa (NYSE:V) and MasterCard (NYSE:MA).

Widespread adoption will be key in moving the value of bitcoin higher; however, it’s important for potential bitcoin adopters to be aware that the world’s first cryptocurrency is not considered legal tender. That means bitcoin is not an acceptable payment method for debt.

“Only the Canadian dollar is considered official currency in Canada,” notes the Canadian government on an information page about digital currencies. “Digital currencies are not supported by any government or central authority, such as the Bank of Canada.”

The complexity associated with bitcoin is a factor that may prevent the asset from ever becoming legal tender. What’s more, the very nature of bitcoin may also be an obstacle to its growth. Born out of the 2008 financial crisis, bitcoin is a response to perceived untrustworthiness in banking and financial systems. These very systems would need to be part of its mainstream adoption.

JUST RELEASED! Are You Ready To Make Money From The Tech Market?

Grab Our Free Outlook Report To Find Out!

2. Bitcoin isn’t as private as it seems

In its early days, bitcoin was often associated with the black marketplace, the Silk Road. The crypto asset, believed to be untraceable, was an ideal way for criminals to move their wares.

As bitcoin’s image became cleaner, its untraceable transactions gave a sense of added security. However, these private transactions may not be as secure or untraceable as many believe.

For example, in late 2020, it was reported that US$1 billion worth of bitcoin linked to the Silk Road had been moved from a bitcoin wallet. It was traced using bitcoin’s cornerstone technology, blockchain.

In the 2008 white paper that introduced bitcoin to the world, creator Satoshi Nakamoto described an immutable, universal ledger that would track and record every bitcoin transaction. The ledger, powered through blockchain, would prevent double spending of bitcoin.

So how does tracing happen? Because bitcoin is not a tangible asset, it is stored digitally, often in bitcoin wallets, which can be housed independently on a private USB stick or at a bitcoin wallet firm.

The concept of a bitcoin wallet is that each user has two access keys. One is a public key that the owner can use to allow other bitcoin users to send or make deposits into their wallet. The other, a private key, is only known by the owner, allowing them to withdraw and move bitcoins from the wallet.

If a person has access to a bitcoin user’s public key, they are able to view every public transaction performed by the key owner, which is equivalent to having access to every receipt from every purchase the person has ever made.

The US$1 billion Silk Road bitcoin move was traced using the bitcoin address 1HQ3Go3ggs8pFnXuHVHRytPCq5fGG8Hbhx. According to Elliptic, a company focused on blockchain analytics and compliance for crypto assets, before the November 2020 transaction, that account held the fourth largest amount of bitcoins globally.

NEW! Gold vs Bitcoin. A Fight For The Future.

Our FREE Outlook Report Will Provide You With EXCLUSIVE Content Such As Expert Advice, Trends, Forecasts and More!

3. Bitcoin is not insured

Bitcoin, like cash or gold, is a bearer instrument, meaning whoever possesses it owns it. However, because bitcoin isn’t government tender or insurable like gold, there is little recourse if it is stolen.

It is estimated that US$1.15 billion in bitcoin has been stolen since 2014. Of that amount, very little has been recouped and none was insured. Most notable is a US$500 million theft from the Japanese exchange Coincheck in 2018.

There are rumblings that crypto insurance is on the way, but in the meantime many bitcoin owners using wallet firms or storage companies will be out of luck in the event of theft. If the system they use is hacked and their bitcoins are stolen, there will be little they can do unless the company has previously agreed to repay any stolen crypto — and also has the financial means to do so.

There’s also the problem of people who have lost their private keys and can’t access their own bitcoins.

“There’s estimates that up til now as much as 20 percent or more of all the bitcoins that are out there are either lost or inaccessible because people have forgotten passwords,” said John Wilson, co-CEO and managing partner of Ninepoint Partners.

Wilson’s firm recently launched the Ninepoint Bitcoin Trust (TSX:BITC.UN) thinking that investors confused by the bitcoin market would prefer a simpler, streamlined way to enter the space.

The world’s first two bitcoin ETFs also launched in 2021 with the same goal in mind.

Securing bitcoin wallets and transactions will become increasingly important as widespread adoption of the crypto asset continues. This will also be compounded by the fact that of the 21 million bitcoins in existence, 18.5 million have already been mined.

Don’t forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

MarketWatch Site Logo A link that brings you back to the homepage.

Chembio Diagnostics stock leaps 62% after company launches rapid COVID-19 test

TaxWatch

‘It can be super, super easy, or it can be insanely complicated’: Need to report bitcoin trades to the IRS? Read this first.

Andrew Keshner

For the first time, the IRS is asking about virtual currency transactions on the first page of its main income tax form

Cryptocurrencies can complicate your tax situation quickly.

- Email icon

- Facebook icon

- Twitter icon

- Linkedin icon

- Flipboard icon

Print icon Resize icon

Referenced Symbols

Treasury Department Secretary Janet Yellen is not big on bitcoin, a point she reiterated recently when she called the digital currency speculative and “inefficient.”

That doesn’t mean Yellen and the department she leads — which includes the Internal Revenue Service — don’t care about the cryptocurrency.

Now that it’s income-tax filing season, people holding bitcoin and other cryptocurrencies will see that the IRS is actually very curious about a taxpayer’s cryptocurrency transactions.

So much so that it has tweaked the first page of Form 1040 — the main piece of income-tax paperwork taxpayers file yearly — to ask taxpayers if they’ve received, sold, sent, exchanged “or otherwise acquire[d] any financial interest in any virtual currency?”

A “yes” could mean more taxes, but not necessarily, tax experts told MarketWatch.

Cryptocurrencies keep achieving a progressively higher profile. Last week, bitcoin hit an aggregate value above $1 trillion. As more people eye cryptocurrencies, more people have to face up to the tax rules at play.

“It can be super, super easy, or it can be insanely complicated,” said Matt Metras of MDM Financial Services in Rochester, N.Y. Some transactions can spur multiple tax events at once, but tax professionals have scant IRS guidance to work off, he said.

Here’s a primer on some tax-time issues when it comes to cryptocurrency.

The basics on how the IRS views cryptocurrencies

The IRS treats cryptocurrency as property. It’s helpful to remember tax rules that also apply on stocks. If value goes up and the owner sells at a profit, they’ll likely pay capital-gains tax.

If a sale at a profit occurs within a year of purchase, the proceeds count as a short-term capital gain. That is taxed as ordinary income, which means it is lumped with other things like wages and taxed at a marginal rate corresponding to the bracket the taxpayer falls into.

If the sale happens at least one year after the acquisition, that’s a long-term capital gain. A single filer making under $40,400 and a married couple making under $80,800 get a 0% rate. Pretty much everyone else gets a 15% rate, with the rate applying to incomes up to $445,850 for individuals and $501,600 for married couples filing jointly.

That’s still a lower rate than five of the seven income-tax brackets.

But cryptocurrency is volatile stuff. For example, shortly after bitcoin’s market value hit the $1 trillion mark, it was on the cusp of entering a bear market.

So it’s important to remember the tax treatment for losses, said Ben Weiss, chief operating officer and co-founder of CoinFlip, which has bitcoin ATMs in 1,800 locations allowing people to buy and sell cryptocurrency.

If the value goes down and the investor sells at a loss, they get a capital-loss deduction. When yearly annual loses exceed yearly annual gains, the taxpayer gets to also deduct up to $3,000 a year. Excess losses beyond that can be carried forward to future tax years.

What if I get paid in cryptocurrency?

When you get paid for services via bitcoin BTCUSD, +1.41% , Ether ETHUSD, +2.05% or any other cryptocurrency, that counts as ordinary income. It doesn’t matter what the medium of payment is when it comes to the question of “whether the remuneration constitutes wages for employment tax purposes,” the IRS said.

Cryptocurrency that an independent contractor receives for work counts as self-employment income, the IRS noted. In both cases, the value of the cryptocurrency is measured by its U.S. dollar value on the date of receipt.

So, how do I respond to this IRS question?

Near the top of the 1040, the IRS wants a yes or no answer to this question: “At any time during 2020, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency?”

Remember, “yes” doesn’t necessarily mean more taxes, experts said. For example, if someone just buys and holds crypto, there’s no tax event because there’s no ensuing sale for a profit or loss, Metras said. Someone like that could check the “yes” to the answer and not have to report the purchase in their return, he added.

Laura Walter, owner of Crypto Tax Girl near Salt Lake City, Utah, says you need to say “yes” if, for example, you sold cryptocurrency, traded it, spent it on goods and services, received it as compensation, or received an airdrop or fork. (A hard fork can happen when a digital coin splits, and an airdrop is a way for a company to hype a coin with a giveaway and airdrop it into ledger addresses. )

Parsing the language on the 1040 instructions, Walter says you can check “no” if you merely held the crypto asset or transferred it among your own digital wallets, and also if you only bought it but did nothing else. “You don’t have to report anywhere how much you’re holding or where. All you report is when you have a taxable event,” she said.

Metras, however, thinks a person should answer “yes” if they merely bought cryptocurrency.

“There’s mixed messages coming out of [the IRS] on who should be checking the box,” Metras said. “I think the IRS and Treasury aren’t sure what data they are trying to get out of the question. … I think the potential repercussions of checking ‘yes’ unnecessarily are much lower than not checking ‘yes’ when the IRS decided you should have.”

Where do I get the necessary tax records?

Brokerage firms will automatically generate the necessary tax paperwork, but that’s not necessarily the case in cryptocurrency exchanges.

The task of tallying up gains and losses can fall on the cryptocurrency holder, Walter said. “My biggest advice to taxpayers is keep track of your records.” Tax software can track transactions, she said. Another way is a simple spreadsheet, Weiss said.

People who have not been keeping close tabs through the year — “basically everyone I work with,” Walter said — can go back and gather up transaction information from their wallets and the exchanges they’ve used. But that takes time.

For the first-timers who got into crypto in 2020 and are sorting out their buys and sells, Walter has another bit of advice, alongside an appointment with a tax preparer: “Just file [for] an extension. You can’t just do this overnight.”

Exchanges like Gemini, Coinbase and Kraken all have to maintain transaction records for five years, Weiss said. Don’t be afraid to contact them if there are questions, he said. “It’s better to talk to customer support and be embarrassed that you don’t know your password than to not have those records,” he said.

What are my audit risks?

They could be getting more serious.

IRS officials could soon be “shifting from education to compliance and enforcement,” according to Metras. Still, he added later, “we don’t know exactly what the enforcement phase is going to look like.”

Giving the virtual-currency question such prominent play on the 1040 is a good indicator IRS officials “are keeping their eye on” crypto assets, Walter added.

Others agree the IRS is getting more serious. “Regulators are poised to commence a flurry of enforcement actions related to virtual-currency tax fraud,” attorneys at BakerHostetler, a national law firm, wrote.

In summer 2019, the IRS sent out more than 10,000 letters to virtual-currency holders who may have failed to report all income and tax obligations. The “educational letters” were part of the IRS’s expanding focus on cryptocurrency, IRS Commissioner Charles Rettig said at the time.

The IRS likely didn’t have its sights on taxpayers with smaller holdings, MarketWatch tax columnist Bill Bischoff said around that time. “The agency is more interested in tracking down individuals and businesses that engage in significant virtual-currency transactions while failing to comply with the tax rules,” he said.

A little tax-time common sense can go a long way. “If you sell $50,000 of bitcoin and a wire transfer shows for that amount, they are going to see it,” Weiss said. “You’re basically rolling the dice if you put $50,000 in the bank and are not reporting anything.”

Read Next

Read Next

‘I want to hurt him the same way he hurt me’: My husband sprung a prenup on me days before our wedding. He kept all copies

‘For two years, I asked for a copy and he couldn’t find it. When I finally had enough, I found it in his office and made myself a copy.’

Buying and Selling Cryptocurrency in Canada: What You Need to Know

This post is sponsored by Canadian Securities Administrators (CSA). All views and opinions expressed represent my own.

Do you know what one of the most common questions I get asked is when I’m doing a financial literacy workshop?

“What are your thoughts on buying and selling cryptocurrency?”

My answer is usually something like this: “Go ahead if you don’t mind gambling with your money.”

Because at the end of the day, that’s pretty much what buying and selling cryptocurrency is like at the moment. I wanted to use the word “invest” when describing cryptocurrency trading just then, but after discussing cryptocurrency at length with the Canadian Securities Administrators, I honestly don’t know if “invest” is an accurate term to use.

You see, cryptocurrency is very new, it’s unregulated, shrouded in mystery, and extremely volatile. Adding all those things up, it has more similarities to betting on horses than buying common stocks.

Nonetheless, a lot of what you’ll find in the media, on blogs and in forums about cryptocurrency is focused on how people have gotten rich off buying and selling cryptocurrency, and why you should think about buying now before missing your chance.

If there’s one thing I hate, it’s anything that perpetuates the idea that it’s easy to get rich quick. Sure, some people have done it, but those people are the exception, not the rule.

So, for this post I’m going to dive deep into the most important things you need to know about buying and selling cryptocurrency in Canada, and why you should proceed with caution (if you proceed at all).

When Did Cryptocurrency Start?

You may be surprised to know this, but cryptocurrency is less than a decade old. The first type of cryptocurrency, Bitcoin, only surfaced in 2009.

Who started it is still a mystery though. Currently, the myth is that Bitcoin was invented by an unknown person or group of people who use the name Satoshi Nakamoto. Even today, the creator(s) of Bitcoin is still unconfirmed.

For a full year, Bitcoin just existed. It wasn’t traded until 2010 when someone traded 10,000 bitcoins for 2 pizzas, as shared by Forbes. I bet that person is kicking themselves now because currently 10,000 bitcoins is worth $90,830,322.42 Canadian dollars. Yikes!

Since then, other types of cryptocurrencies have been created. We’re all probably most familiar with the following 10 types of cryptocurrencies outside of Bitcoin, but there are actually 1,900 different types listed on CoinMarketCap.

- Litecoin (LTC)

- Ethereum (ETH)

- Zcash (ZEC)

- Dash (DASH)

- Ripple (XRP)

- Monero (XMR)

- Bitcoin Cash (BCH)

- NEO (NEO)

- Cardano (ADA)

- EOS (EOS)

What Is Cryptocurrency?

In case you’re still unclear what cryptocurrency is, it’s basically a digital asset that uses cryptography (the act of writing or solving codes) for security. Right now, it’s “not issued by any central authority, rendering it theoretically immune to government interference or manipulation” (Investopedia). For some people, that’s the biggest allure of cryptocurrency. For others, that’s a reason to stay far, far away from it.

Is Cryptocurrency a Type of Currency?

This is definitely up for debate, but the Bank of Canada would say no, cryptocurrency isn’t a type of currency. A better term would be a cryptoasset or digital asset.

The reason for this is because typically currencies are widely accepted, and are issued and regulated by a government. Even though Bitcoin is the most popular form of cryptocurrency, it’s still not widely accepted throughout Canada or the world as a form of currency. And as mentioned above, it’s not issued or regulated by any government or any centralized organization.

The counter to this argument would be that shouldn’t something that you buy, sell or use to purchase goods or services be considered a type of currency?

For instance, the following retailers do accept Bitcoin as payment:

It’s not a long list, but it is possible to use bitcoins to buy a flight or donate funds to Wikipedia.

Still, in reality, using bitcoins as if they were Canadian dollars isn’t easy. I have first-hand knowledge of this since I participated in the Money 20/20 Race last October. I luckily only had to get myself from Toronto to Las Vegas (with a number of stops and challenges along the way) by using my chip and pin credit card. But the winner of the race, Amelie Arras, had the hard task of doing the race using only bitcoins.

That being said, although she did win (which was amazing!), she was able to do so not because it was easy to pay for things with bitcoins. She was able to travel and survive the race because she traded her bitcoins with members of the Bitcoin community in exchange for them to buy her flights, food or accomodations. If we’re going to get technical, she was able to trade it, but not use it to buy goods and services. That’s very different than using it the same way we use dollars.

Is Cryptocurrency Backed by a Bank or Authority?

Cryptocurrency isn’t issued or regulated by any type of bank or government, which is why it’s not backed or insured like Canadian currency is.

Canadian currency that is deposited into a Canadian financial institution is insured by the Canada Deposit Insurance Corporation (CDIC) up to a maximum of $100,000 per financial institution. That means if the bank you use goes bankrupt, and you have $1,000 in a chequing account and $10,000 in a savings account, your $11,000 will remain safe. You’ll get a payout by CDIC.

Unsurprisingly, there’s no similar insurance for cryptocurrency, which is why it’s considered to be very risky.

Is Cryptocurrency a Type of Investment?

Depending on who you ask, you could get a “Yes” or “No” answer. For me personally, I would lean more towards a “No” just because it’s so new, it’s unregulated, it’s extremely volatile, and there aren’t as many rules in place compared to other investment types.

For instance, for traditional trading of stocks, bonds, ETFs and derivatives, there are exchanges with rules and hours of operation. With cryptocurrency, there are virtually no rules and exchanges operate 24 hours per day.

Now, if you wanted to go back to the basic definition of investing, which is buying an asset in the hopes that it increases in value to earn you a profit, some would argue that cryptocurrency would fit the bill. But still, it’s important to take note that the cryptocurrency markets are not transparent and the trading platforms you must use to buy and sell cryptocurrency aren’t regulated either.

Is Cryptocurrency Safe?

In my opinion, cryptocurrency is one of the most volatile and risky assets you can buy today.

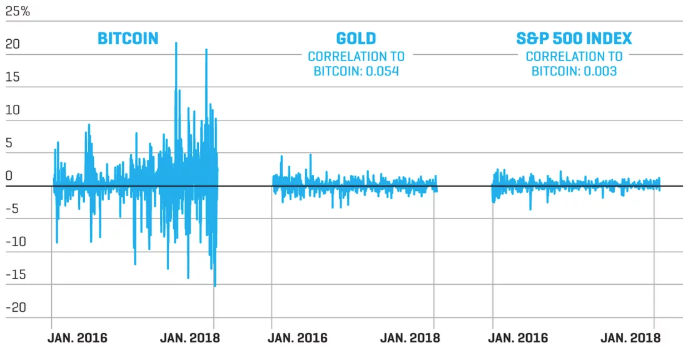

Let’s first talk about volatility. Let’s compare the daily volatility of Bitcoin to gold and the S&P 500 Index from 2016 to 2018. Here’s a chart that shows just how volatile, and thus risky, Bitcoin is to gold and the S&P 500 index found on Fortune.com.

If that doesn’t make you feel a bit anxious, it should! I don’t think I’d be able to handle the constant ups and downs of Bitcoin without feeling nervous for my money.

But that’s not the only reason cryptocurrency in general isn’t considered a safe asset to buy. There is also a high susceptibility to cybersecurity threats and hacks. For some examples, the defunct exchange Mt. Gox was robbed of $500 million in Bitcoin in 2014, Bitfinex was robbed of $72 million in Bitcoin in 2016, and a number of Coinbase customers were robbed in 2017 (Fortune).

Final Thoughts on Buying and Selling Cryptocurrency

Is cryptocurrency something you should stay away from at all costs, or is it worth the risk for a huge reward? This may sound like a cop-out, but it just depends. Cryptocurrency is still so new, mysterious and unpredictable. People have had major losses when buying and selling cryptocurrency, and people have become millionaires.

At the end of the day, it really depends on your goals and your risk tolerance. If you don’t have the stomach for something with such high volatility and would rather buy assets that are more secure, then cryptocurrency is not for you.

For those of you who have an exceptionally high tolerance for risk, and are comfortable with the idea that you could potentially lose all the money you put into cryptocurrency, then go ahead and try it out.

If you’re not really sure how you feel about cryptocurrency, but are worried that if you don’t buy know you’ll be kicking yourself later, there are plenty of other things you can invest in to gain significant returns that may still be a better fit for you.

The important thing to remember is that before buying any type of cryptocurrency, make sure you know what you’re getting yourself into and understand the consequences.

For more information about securities regulation and investing, make sure to check out the Canadian Securities Administrators’ website.

Tempted to invest in Bitcoin? Here are a few things to consider

- comments Leave a comment

- facebook Share this item on Facebook

- whatsapp Share this item via WhatsApp

- twitter Share this item on Twitter

- email Send this page to someone via email

- more Share this item

- more Share this item

With Bitcoin briefly crossing the US$11,000 mark on Wednesday, you might be wondering whether you should get in on the action.

After all, one Bitcoin was trading for less than US$750 this time last year. If you’d bought $100 worth of Bitcoin 12 months ago, you’d be over $1,000 richer today.

And since mid-November alone, the cryptocurrency has nearly doubled in value. The thing is, though, that no one is quite sure why.

Bitcoin bubble?

There are a few convincing theories about why Bitcoin’s value has been rising since debuting in 2009 when it was only worth a few cents.

According to Andreas Park, professor of finance at the University of Toronto, Bitcoin has “deflation built into it,” because whoever set up the digital currency – a programmer or group of programmers whose identity remains unknown – established a finite supply of it. There can only be 21 million Bitcoins in the world, a ceiling that keeps getting closer.

There are currently around 16.7 million Bitcoins in circulation, according to Coin Market Cap, and 12.5 new Bitcoins are created every 10 minutes on average, although that pace is set to slow down in the future.

Bitcoin’s limited supply means its value tends to go up over time as demand for it increases and people come to expect that it will keep appreciating. It’s the opposite of what generally happens with traditional currencies, whose supply is regulated by central banks that aim for low and steady inflation.

As to why demand is increasing, Anthony Diiorio, founder of Toronto-based fintech and cryptocurrencies company Decentral, believes that’s primarily because more and more investors are beginning to understand the enormous potential of blockchain, the technology that underpins Bitcoin.

Before blockchain, anything digital could be easily duplicated, which made it impossible to create a digital currency. Blockchain solves this problem by providing a way to keep track of who owns what and when that ownership is transferred, creating a decentralized network for moving value that doesn’t need to rely on a central authority or intermediaries.

More and more people are realizing that blockchain will do to humanity’s ability to store and transfer value what the internet did to people’s ability to spread information, said Diiorio, who used to be chief digital officer at the TMX Group and the Toronto Stock Exchange.

The fact that Bitcoin has a supply cap and keeps growing in popularity among investors may explain why it has been rising. But why that climb has turned into skyrocketing appreciation in the past few months remains a mystery.

As Bloomberg columnist Stephen Gandel recently noted, Bitcoin has now soared far beyond where tech stocks were in the dot-com bubble.

WATCH: Finance expert Preet Banerjee: Should you invest in Bitcoin?

High volatility

If the current Bitcoin rally is a bubble, it might burst. But what might cause the pop and when is also hard to tell.

One thing is for sure: While the cryptocurrency has been climbing much faster than major stock indices this year, it is also many times more volatile. Just this week, it rose above US$11,000 on Wednesday only to plunge below $9,500 on the same day.

The drop appeared to be the result of cyber attacks against Bitcoin exchanges aimed at triggering a depreciation, said Diiorio.

Get used to hacking attempts if you invest in Bitcoin, because they happen often. And while Diiorio noted that their impact is short-lived, several Bitcoin exchanges have been victims of high-profile thefts.

And if Bitcoin seems to regularly rebound from temporary drops, it might soon encounter a more formidable roadblock: government regulation.

“Governments are concerned with losing control of currencies and potential money laundering,” said Diiorio.

Indeed, Bitcoin has made its share of headlines for its part in facilitating the flourishing of online black markets like the Silk Road, where criminals went to buy and sell drugs and perform other illicit transactions.

Diiorio is optimistic about regulators’ ability to apply a light touch to the emerging cryptocurrency market. Others aren’t.

There is also the question of whether and how long Bitcoin will maintain its dominant position. Ethereum, a blockchain-based computing platform that Diiorio co-founded, for example, is rapidly gaining steam. So are Bitcoin spinoffs Bitcoin Cash and Bitcoin Gold.

WATCH: New bitcoin fraud sends real police officers to your door

Not the kind of money that buys coffee

Most people buy Bitcoins and other digital currencies on online exchanges, although people also trade directly with each other on online marketplaces. There are also Bitcoin ATMs in a number of Canadian cities that will also allow you to trade cryptocurrencies for cash.

You don’t need to buy a whole $10,000-worth Bitcoin. Bitcoins can bit sliced up into up to 100 million bits. The smallest unit is a Satoshi, named after, Satoshi Nakamoto, the mysterious creator of the currency. It is currently worth around US $0.0001.

When it comes to spending your digital riches, though, the options are limited. A growing number of retailers and service providers are starting to accept Bitcoins. But while you might be able to use your digital tokens for a new laptop or even plastic surgery, you might want to stick to cash for small purchases.

The average fee for a transaction was recently hovering around $7, said Park. That’s great if you’re transferring $100,000 worth of value but not so great if you’re buying a $4.50 latte.

Still, users don’t always have to pay for transferring Bitcoins, according to Coindesk.

More fundamentally, though, it is the collective expectation that Bitcoin will continue to increase in value that makes it a flawed means of exchange.

Instead of spending their digital money, “people hold on to their Bitcoins because they believe that sometime in the future they will be worth more,” said Park. And that, he added, is not “how good money works.”

5 facts you didn't know about Facebook Libra

Maksym Khudiakov

Details of Facebook cryptocurrency platform, called Libra, have become known eventually. In this blog post we will try to analyze, what does Libra bring to the cryptocurrency world and whether there are enough organizational and technical preconditions for Facebook coins to be adopted.

What is Libra?

1. The difference between Libra and other cryptocurrencies

We all have witnessed the rise and fall of Bitcoin and altcoins, we have seen enough to be skeptical about yet another cryptocurrency.

So how is it different and why Libra has to become a worldwide payment tool?

The most significant reason why Libra is to be successful is believed to be not a technical one, but rather related to Facebook's ability to reach its audience of 2.38 billion users. First applications to adopt the cryptocurrency will be Facebook Messenger and WhatsApp.

Another reason is that Facebook isn’t going to control the cryptocurrency, but will have just 1 vote in governance among other investors, which have shown their interest and have invested into it $10 million each. There are such big names, as Vodafone, Uber, Thrive Capital and others (21 companies so far).

It should be reminded that Visa, MasterCard, eBay and Stripe that were in the list of Libra's investros, left the Facebook's Libra Association.

These companies have sufficient reach and resources to adopt the cryptocurrency and blockchain technology, to give another breath to it.

2. Libra will be a stablecoin

Libra cryptocurrency will be a stablecoin, as claimed by Facebook. Thus Libra holders can be sure that the value of their assets won’t blur or disappear over time. Libra cryptocurrency value will be tied to a basket of short-term government securities based on international currencies, such as the dollar, pound, euro, and others.

3. Libra’s Speed

Libra blockchain will handle 1000 transactions per second. That is huge compared to the Bitcoin’s 7 or Ethereum’s 15 transactions per second.

Such throughput is achievable by limiting the number of peers capable to verify the transactions. In Libra network those peers are presented by the founding companies, 28 companies so far.

4. Libra isn’t decentralized enough

Libra is built as a permissioned blockchain, where only known peers take part in transaction validation and consensus achievement. Such implementation isn’t decentralized enough and implies the related risks of data to be changed or the inability for some peers to perform a transaction (censorship).

The final destination for Libra is to become a permissionless blockchain based on Proof-of-Stake algorithm.

5. Move and Smart Contract

Despite Libra implementation isn’t a fork of Ethereum (like JPMorgan’s Quorum) it is built considering all today’s experience and issues related to the Bitcoin and Ethereum implementation.

Similarly to the Ethereum, there is a form of a Smart Contract supported, so alongside the transaction within the network there can be the custom business logic executed leading to the global state change.

Such custom logic is to be written using Move programming language, introduced by Libra. You should consider it as Solidity for Ethereum. The only reason there is another language instead of Solidity is that developers have taken into account all the related security incidents which have ever happened with Smart Contracts and created a language that is designed with safety and security as the highest priority.

Summary

The goal for Libra is to provide a stable Facebook currency to the world built on a secure and open-source blockchain, backed by real assets and governed by independent organizations.

Libra developers haven’t gone their own path but rather leveraged on today’s bright ideas implemented within an Ethereum network. Libra cryptocurrency is supported by the huge corporates within different business domains, including the financial ones. All of that provides the hope for the blockchain technology to be adopted widely and to be moved to another level, where the government takes a pro-active part.

Bitcoin investors: From buying a Bentley to losing it all

By Zoe Kleinman

Technology reporter

Bitcoin has soared to trade at an eye-watering $48,000 (ВЈ34,820), following the news that Tesla has bought $1.5bn of the crypto-currency.

Enthusiasts will tell you it's the future of money - but investing in the notoriously volatile virtual currency can be a rollercoaster, and it's not without risk. The hunt for new coins, using powerful computers, is also causing a surge in energy demand - which is not so good for the environment.

Here are some of your Bitcoin adventures.

'It paid for a holiday in Iceland'

James Saye, tech consultant

I first invested in Bitcoin in 2017 - I was nervous about putting too much in, so I went for around ВЈ500.

I cashed it in for ВЈ2,500 during one of its peaks, and had a great holiday in Iceland - the cash came in handy, Iceland is lovely but expensive.

I bought in again in 2018 when the price was lower so I'm still in but I don't regret cashing out when I did.

'It's part of my pension plan'

Heather Delaney, founder of Gallium Ventures

I've been the silent crypto-investor. I put in ВЈ5 at the very beginning and I've built it slowly and steadily over time. I see it as a long-term strategy, meaning the rapid highs and lows are not ones that cause me anxiety - although ask me as I near my retirement and we shall see what I think then!

Based on how much I have invested in Bitcoin over time versus what I see today, I have a 585.41% increase in my investment.

I've never cashed it out - but I have converted some to other currencies as the market has fluctuated.

I know loads of people who have done exciting things with their investments but for me it's part of my pension plan. I know I'm not typical.

'He didn't get a single penny back'

David Stubley, founder of 7 Elements cyber-security firm

We had a client whose Bitcoin wallet was fraudulently accessed and all the money was transferred out of it. He had intended to use it as a deposit on a house.

The man had been spooked by reports of fluctuations in the currency and decided to check his wallet. But he clicked on a fraudulent link, which led him to a phishing site, a complete clone of the real thing.

He had 84 bitcoins, and the fraudsters transferred 83 of them. At the time, in 2017, they were worth $475,000.

We tracked the payment on the blockchain [a kind of shared digital public ledger] - we could see it rolling across various wallets and finally it reached a wallet containing $15m of currency.

While the final identity of the fraudsters could not be identified, we were able to have the wallets frozen, so at least denying access to the stolen funds.

Our client was irate but philosophical. Today, that stolen Bitcoin would be worth ВЈ2.8m.

Once it's gone, it really has gone.

'I bought a Bentley'

Javed Khan, independent trader

My Bitcoin journey didn't start as an investment. At first, it was a form of transferring money, I didn't have to wait for confirmation from banks and so on - it was convenient.

In 2018, I noticed I'd make a transfer, leave some Bitcoin in my wallet and I'd see the prices go up - and before I knew it I was seeing profit, which surprised me. I had been telling my friends I was using it as a transfer tool, I hadn't thought about investing in it.

In January 2020, I cashed in my Bitcoin profits and bought a Bentley in Dubai, where I now live. I sent a video from the showroom to my mum and she cried, she was really proud.

I would only put in money that I could afford to lose. The most I've lost is the transaction fees - when the price drops I don't lose faith.

I think the best time to buy Bitcoin is when nobody's talking about it - wait for the hype to die down.

'My electricity bill was A$600 a month when I was mining Bitcoin'

Rohan Muscat, project manager and electrical engineer

I became aware of Bitcoin in 2010, but being a bit of a hardware geek, I wanted to mine it. In late 2016 I bought a pair of graphics cards to mine, and at first I did pretty well with it.

A start-up I'd done some consulting for gave me some Horizon State tokens (another form of crypto-currency) to pay part of my way, and in January 2017 those plus my mined assets were worth A$40,000 (ВЈ22,000).

I decided to trade it a bit, and investigated bots while moving to bigger scale mining.

At first it paid for itself, but then it went downhill and was borderline break-even. My electricity bill shot up to A$500-A$600 a month, because the mining rig needed so much power.

I ended up selling the mining gear, and I'm currently sitting on about A$2,000 in crypto.

I could have made more if I'd jumped in and out, but the emotions and risks in trading have burnt me, and I'd rather not take the risk.

'Bitcoin helped me buy my house'

Daniel Crocker, business owner

In 2012, I was doing an apprenticeship at an IT company. At lunchtime we used to chat about little ways of making money on the side. Nobody had really heard of Bitcoin but we decided to give it a go and we spent a few weeks on it.

It didn't last long, but luckily I kept hold of mine.

I traded them in last summer and got half the deposit for my house. I've still got a little bit but I'm just going to sit tight - it's not something I want to pin my future on.

I do know people who have gone in deep but I think I've been lucky enough already.

What Will Be the Next Bitcoin?

This article/post contains references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services.

If you haven’t yet taken notice, Bitcoin has made an incredible recovery recently. As of February 2021, Bitcoin is rapidly surging and has reached a new record high of $55,000 USD per coin.

In 2017, Bitcoin and other cryptocurrencies increased in popularity as the public took interest. Bitcoin crashed, however, from its December 2017 high of $18,640 all the way down to $3,360 in December 2018. It’s been trending upwards ever since, and 2020 has suggested its peak is still to come.

If you’re here, then you’re looking to invest in the next big cryptocurrency. Here is our list of the ones to look out for.

Cryptocurrencies to Watch in 2021

In 2017 and 2018, hundreds of new cryptocurrencies flooded the market with Initial Coin Offerings (ICO). Virtually every single one grew exponentially in value as soon as it was made available to consumers. It was pure cryptomania!

Unsurprisingly, when the hype died down, most alt-coins didn’t stand the test of time. There are currently more than 5,000 cryptocurrencies available but less than 1,000 are actively traded on exchanges and even fewer have viable economic prospects.

At the risk of making your head spin, here are the cryptos we’re currently watching. Before you take the plunge, ask yourself, “Which of these will be around in ten years?” Cryptocurrency markets are highly volatile and as an investor, you have to have the stomach to tolerate dramatic price fluctuations.

If we’ve learned anything from the crypto market in 2017 and 2018, it’s that what goes up usually comes down – and many coins don’t come back!

The Major Players

Bitcoin, Bitcoin Cash, Ripple, Ethereum, and Litecoin round out the top 5 cryptos. The current market capitalization of all cryptocurrencies is around $237 billion; almost two-thirds of that is represented by Bitcoin and Ethereum.

Ethereum was developed by Russian techie, Vitalik Buterin, in 2015 and carries a current market capitalization around $40.6 billion. Ethereum was built for creating “smart contracts,” which are ‘If/Then’ commands. It could be something like, “If Sally is never late for work, then she gets paid $xx” or if you input certain data, you’ll get a soft drink. When you put many smart contracts together you get something called a dApps, decentralized applications. dApps are tamper-proof as they directly connect the user and provider, cutting out the middle-agent who stores and has control over the information (think gmail). The vast majority of cryptocurrencies are actually dApps that run on the Ethereum blockchain.

Litecoin was launched in 2011 and co-founded by a former Google engineer. It allows for fast, low-cost global payments through its decentralized network. It is supposed to be a faster version of Bitcoin with a larger supply of coins, which led it to often be likened as “the silver to Bitcoin’s gold”. While a very popular choice next to Bitcoin and Ethereum in 2017, it hasn’t hit quite the same recovery as those coins in 2020. Nevertheless, its technical advantages and credibility make it a likely long-term contender in the world of crypto.

Ripple was launched in 2012 and is based in San Francisco with offices in 27 countries. Ripple focuses on multi-currency transactions which are cheaper and faster than Bitcoin. By the end of 2017, the company already has more than 100 international banks signed up to its platform, RippleNet. To date in 2020, the coin is up nearly 300%. Ripple is estimated to have a market capitalization of $332 billion. Its token is called XRP.

The Runners Up

Tether (USDT) is a unique cryptocurrency because its value is “tethered” to the US dollar. Every Tether coin remains valued at $1 USD, which insulates it from the major price fluctuations characteristic of most cryptocurrencies. This has earned it a characterization as a “stablecoin” and may pave the way for the digitization of the US dollar in the future. Tether is a great option for those looking for a stable cryptocoin to store value in.

EOS is one of the most actively traded cryptocurrencies on the exchanges. Unlike other cryptocurrencies, the coin launched with a year-long ICO to avoid the characteristic run-up and crash that have plagued pretty much every other coin. As a result, EOS displays less volatility than other coins on the market, which is an attractive feature for those wary of the ups and downs of crypto.

Binance Coin (BNB) was launched in mid-2017 by the Binance Decentralized exchange, or DEX. You can buy and sell thousands of different cryptocurrencies on the DEX, but users get a discount if they pay fees with Binance. Since DEX is the largest cryptocurrency exchange in the world, this incentivizes users to trade Binance, ensuring its longevity and growth.

Honourable Mentions

Stellar Lumen (XLM) was founded in 2014 by Ripple co-founder Jed McCaleb. Stellar is an open-source blockchain that settles global financial transactions, like a currency exchange, within 2-5 seconds making it much faster than Bitcoin. Its market capitalization is nearly $9.2 billion.

Tezos (XTZ) is becoming the most popular cryptocurrency for new projects, and as a result is up by over 85% since the start of 2020. Many are suggesting Tezos might ultimately surpass Bitcoin, as it’s both more scalable and less resource-intensive.

Bitcoin Satoshi Vision or Bitcoin SV (BSV) was created in 2010 by forking the Bitcoin Cash blockchain. The intention was to make Bitcoin more scalable by increases block sizes so they could work faster and carry more information. BSV, however, has not been without conflict and disputes at previous peak-crypto in 2017 and 2018 led to the project being split off entirely from Bitcoin. Despite disagreements and feuds among members, Bitcoin SV still remains a popular choice among crypto investors.

Chainlink (LINK) quietly soared up over 600% in 2020 while everyone was focused on Bitcoin. This Ethereum-based token is gaining popularity and has occasionally surpassed both Bitcoin and Ethereum in single-day trading volume on major exchanges. Chainlink functions to connect smart contracts to external data sources, adding a security layer for large transactions.

NEM (XEM) launched in 2015 and seeks to address the perceived failings of Bitcoin; requires less computational power and has a proprietary feature that sifts out “bad actors” in the network. NEM rewards miners based on their involvement in the “community,” not on their computational capacity or stake size. This coin is up over 500% this year.

Monero (XMR) was created in 2014 with no maximum cap for mining, unlike Bitcoin. It’s regarded as one of the most private and anonymous cryptocurrencies and gained public notoriety when Mariah Carey and Toby Keith sang its praises. While it hasn’t had the major run-up as some other cryptocoins on this list, it has definitely come back to life in 2020 and is trading at 3x what it did at the start of the year.

NEO – Launched in China, NEO facilitates smart contracts that also combine digital assets and digital identities. It has a total supply of 100 million tokens and gives holders the right to manage the network and vote for team members. Blocks are generated every 10-20 sections and cannot be forked or withdrawn once validated. While up over 100% this year, it’s down 90% from its previous all-time high.

Where Do I Buy Cryptocurrency?

You can’t buy Bitcoin from your local bank, or even on the stock exchange with your brokerage account. In order to buy and sell cryptocurrency, you need a digital wallet and platform that allows you to trade crypto.

Wealthsimple Crypto

Wealthsimple launched Wealthsimple Crypto , which allows you to buy and sell digital currency using their Wealthsimple Trade platform, If you’re already a Wealthsimple Invest or Wealthsimple Trade customer, you’ll recognize the same stellar user experience with the Crypto platform.

When you sign up, deposit and trade a minimum of $100, you can get a free $25 cash bonus and commission free trading on Wealthsimple Crypto.

At present, you can only buy and sell Bitcoin and Ethereum on Wealthsimple Crypto, so it’s more limited than other exchanges. Wealthsimple is always innovating and adding features to their platforms, so we can expect more cryptocurrencies to be supported in the future.

Coinsquare

If you find the Wealthsimple Crypto selection too limiting, Coinsquare is your next best bet. Coinsquare supports all major coins such as Bitcoin, Ethereum, Litecoin, Ripple, and more. You can build a much more well-rounded cryptocurrency portfolio on this platform.

Coinsquare stands out above competitors for their ultra low fees but new deposits are subject to a 7-day hold. With cryptocurrency prices so volatile, a full week hold feels like an eternity when you’re waiting to invest!

Coinbase

Coinbase is another great choice if you’re looking for a cryptocurrency platform that supports a number of different coins. Not only can you buy Bitcoin, Ethereum, and Litecoin, you can also pick up alt coins like Chainlink, Dash, EOS, and Tezos.

Coinbase will let you buy a fixed amount of cryptocurrency on a weekly or monthly basis, making it easy to automate your investment portfolio. You can even directly charge a credit card, making it easy to fund your account and even earn credit card rewards on your cryptocurrency purchases. This convenience comes with a downside. Coinbase charges very high fees compared to its competitors, charging $0.99 to $2.99 USD per trade. If you’re buying bitcoin with a debit card, expect to pay 3.99% in fees. Yikes!

Final Thoughts

When it comes to investing in cryptocurrency, there’s still tremendous risk and volatility involved. Since crypto’s peak in 2017 and the subsequent crash in 2018, a few coins have shown they’re likely here to stay.

If you’re investing in cryptocurrency, make sure it fits with your overall investment strategy. Just like you wouldn’t invest all your money in a single stock, you shouldn’t put all your money into a single coin. Make sure to diversify your investments in cryptocurrency, and make sure to stay invested in the traditional stock market while you do so. Finally, you should also make sure you’re privy to the latest crypto trading tips and best practices before you start buying and selling.

So, let's define, what was the most valuable conclusion of this review: 5 Things You Didn't Know About The Duchess Of Cambridge 5 Things You Didn’t Know About Montgomery. Allison Kay. Published: Janu. Italika. Share on Facebook; Share on Twitter; I love putting the at 5 Things You Didn't Know About Cryptocurrency in Canada

Contents of the article

- 5 Things You Didn't Know About The...

- 5 Things You Didnt Know Cryptocurrency

- Five Things You Didn't Know About...

- 5 Things You Didn’t Know About Naomi...

- 5 Things You Didn't Know Your Tablet...

- 3 Surprising Things You Didn’t Know...

- NEW! Gold vs Bitcoin....

- 1. Bitcoin is not legal tender

- JUST RELEASED! Are You Ready To Make...

- 2. Bitcoin isn’t as private as it seems

- NEW! Gold vs Bitcoin....

- 3. Bitcoin is not insured

- MarketWatch Site Logo A link that...

- TaxWatch

- ‘It can be super, super easy, or it can...

- For the first time, the IRS is asking...

- Cryptocurrencies can complicate your...

- Referenced Symbols

- The basics on how the IRS views...

- What if I get paid in cryptocurrency?

- So, how do I respond to this IRS...

- Where do I get the necessary tax...

- What are my audit risks?

- Read Next

- Read Next

- ‘I want to hurt him the same way he...

- Buying and Selling Cryptocurrency in...

- When Did Cryptocurrency Start?

- What Is Cryptocurrency?

- Is Cryptocurrency a Type of Currency?

- Is Cryptocurrency Backed by a Bank or...

- Is Cryptocurrency a Type of Investment?

- Is Cryptocurrency Safe?

- Final Thoughts on Buying and Selling...

- Tempted to invest in Bitcoin? Here are...

- 5 facts you didn't know about Facebook...

- What is Libra?

- 1. The difference between Libra...

- 2. Libra will be a...

- 3. Libra’s Speed

- 4. Libra isn’t decentralized...

- 5. Move and Smart...

- Summary

- Bitcoin investors: From buying a...

- 'It paid for a holiday in Iceland'

- 'It's part of my pension plan'

- 'He didn't get a single penny back'

- 'I bought a Bentley'

- 'My electricity bill was A$600 a month...

- 'Bitcoin helped me buy my house'

- What Will Be the Next Bitcoin?

- Cryptocurrencies to Watch in 2021

- The Major Players

- The Runners Up

- Honourable Mentions

- Where Do I Buy Cryptocurrency?

- Final Thoughts

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.